Approaching Debt Repayment as a Moderator Instead of an Abstainer Will Make Your Life Easier

/Are you a moderator or an abstainer? Have you heard of those concepts? Here are a couple of good links explaining it: Are you an abstainer or a moderator? | Abstainers vs. Moderators

Abstainers vs. Moderators in Dieting & How It Relates to Your Finances

So obviously there’s a dietary concept of moderators and abstainers: Moderators succeed best by including small treats in their eating plans, while abstainers succeed best by permanently eliminating all “problem foods” from their diets (aka anything that might tempt them or make them feel ill).

Other bloggers describe these two behavioral types as functions of peoples’ personalities: how do you react to off-limit items? Does it eliminate your desire to eat them if you have decided it’s not in your plan, or does it make you want it even more? If you allowed yourself the occasional treat, would that satisfy you and spur you on or cause you to binge on that item and derail you completely?

I’m not sure if everyone falls neatly into these categories (probably not, let’s be real. I LUV personality tests/classifications: all the other INFJ6w5sAquariusFirstBorns, what is up?!?!, but they are definitely not end-all-be-alls); however the basic categories are useful when you’re considering a debt repayment plan.

Debt repayment is a lot like dieting, as many people have written.

Like dieting, there are endless choices on how to manage your finances, some of which are pretty extreme. And also like dieting, most people can’t and shouldn’t sustain long-term extremes in their financial plans.

Certainly there are exceptions: if peanuts are going to kill you or you MUST lose 100lbs because a heart attack is imminent, you better take drastic measures to eliminate the problem with almost no exceptions. Think My 600-lb Life. No holds barred.

Similarly, if your debt and expenses are more than your income, your bills are in collections, and you’re about to lose your apartment, you better abstain from unnecessary spending for as long as it takes to stabilize your finances. Period. That sucks, but you’re one extra long, hot shower away from literal financial ruin so you better saddle up and get yourself out of the Valley of the Shadow of Bankruptcy before you even think about ordering pizza.

But most of you aren’t in that precarious of a position, right? Most people have debt, aren’t saving enough, are spending too much, aren’t making enough, or some combination of all of the above, but not all of them together at freakout levels. If you’re not where you want to be, but you aren’t in dire financial straits, let’s look at your options for paying off debt.

Let’s Reevaluate The Concept of Abstention in Budgeting. We’re Not Talking Lattes & Lunches Out

I want us to view “abstention” a little differently in the financial sense than the example I gave above (go hard in every aspect of everything and avoid anything that is going to slow down progress toward the primary goal). I’m not going to preach the virtues of “building treats into your budget” because that’s a well-documented concept in pretty much any debt repayment plan. Building coffee into your food budget is still ok, as long as you know you’ll have to take it from somewhere else. In fact, if you don’t build in some kind of treat or fun money for yourself, you’ll get off track no matter what financial plan you’re following.

But I’m talking about OVERALL financial strategy. Completely putting off entire types of wealthbuilding is NOT for everyone. And some personal finance gurus and bloggers preach Abstention from Wealthbuilding Until All Debt is Paid like it is the Gospel.

So what are your choices and how do you know which one will work for you? Think about whether you’re more of an abstainer or a moderator and keep that in mind as I describe the options below.

Option 1: Abstain Until All Debt is Paid (i.e. Dave Ramsey Baby Steps)

For those of you who don’t know, Dave Ramsey’s “Baby Steps” plan is focused on becoming debt free as quickly as possible, whatever it takes, then investing and building a financial cushion for yourself. The 7 steps are:

Dave Ramsey has a #process

You’re supposed to follow these steps exactly, and if you don’t, there’s an army of Babysteppers ready to judge and harangue you (and don’t even THINK about actually calling into Dave’s show unless you want to feel like a kid with her hand in the cookie jar).

The plan requires you to throw everything at non-mortgage debt until it’s gone after you’ve saved $1,000 for emergencies. This means NO retirement or investment savings for years; maybe even decades. And even then, only 15% of your income is supposed to go to your retirement accounts while you save for your kids’ college.

You’re supposed to use cash only and cancel/cut up all of your credit cards, never to be used agian. You pay for everything with cash. Your goal is to eventually not even have a credit score. Credit scores are for suckers or something, IDK.

Dave tells you to sell everything you can. Live on rice and beans, beans and rice. Get a beater car. Kill the debt. I haven’t actually read Dave Ramsey’s books or listened to his radio show (I would honestly rather throw myself off a building than listen to him, although that’s a whole other story), but I’ve read enough to get the gist of his plan and why he thinks it’s not only the best plan, but basically the only way to live. My parents have a Financial Peace University kit gathering dust in their basement, so you can trust me, you guys.

Anyway, it’s pretty extreme. It WORKS for a lot of people who are in BIG messes or who would go off the rails without strict rules. The Abstainers.

If you’re an abstainer, Dave’s plan might be the way to go, particularly if you have a good amount of debt and absolutely no control over your finances.

Credit cards pose risk of misuse. Credit generally poses risk of misuse. Allowing yourself the opportunity to spend more than you’ve specifically budgeted poses risk. Having debt is riskier than being debt-free and abstention debt-based financial plans (pay the debt first, exclusively and ASAP) Knowing your level of self-control and your priorities can help you decide if this is a good option for you.

But if it’s not….

Option 2: Moderate by Shoveling from Both Ends

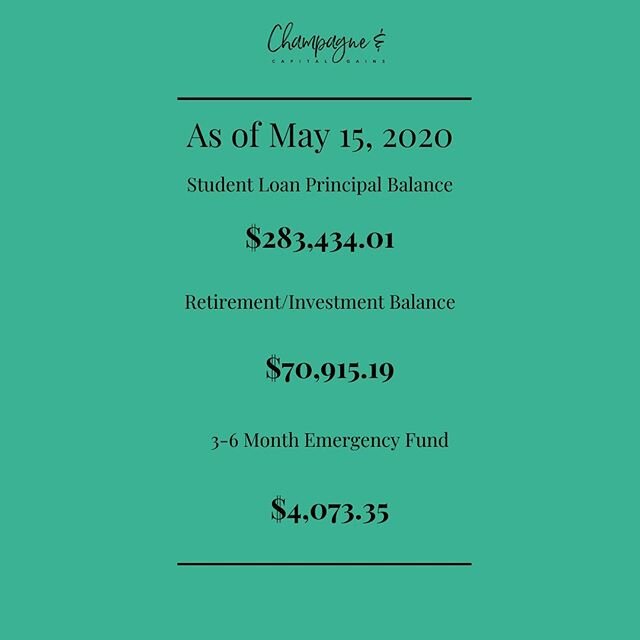

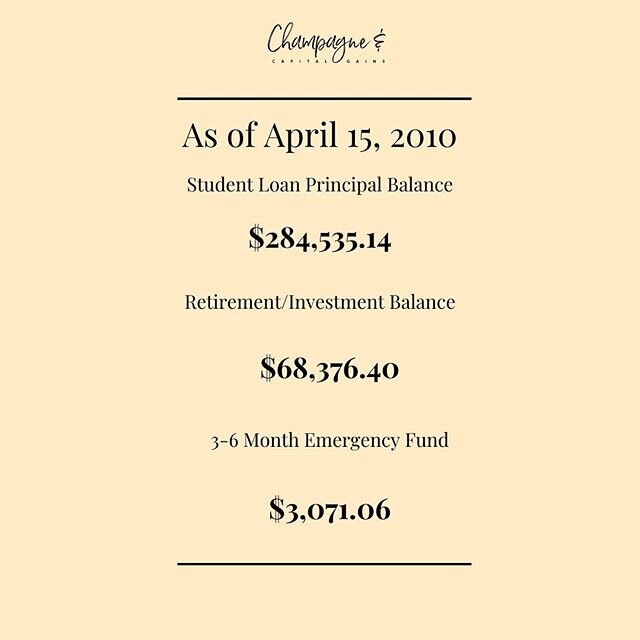

This is the best strategy for me. If you’re thinking of getting out of debt as shoveling (which is kind of counterintuitive now that I think about it...aren’t you like, in a hole? Shouldn’t you be building a staircase or something? Whatever, I’ve gotten off track), shoveling from both ends would be repaying debt with one shovel and building an emergency fund with the other.

Both increase your net worth, but you’re contributing to two goals simultaneously instead of only one. Which for moderators probably reduces stress. I know it does for me.

Paying down debt to the exclusion of almost every other financial priority never appealed to me. Why would I keep my taxable income as high as possible by not contributing to a 401k? If my company matched, why would I also leave LITERAL FREE MONEY ON THE TABLE so I could repay my debt a little bit faster?

My calculus may come from having a high income (i.e. I have money to do almost all the things, so I don’t have to choose), but honestly lower incomes benefit even more from reducing their incomes with 401k contributions - if you get your taxable income low enough, you might qualify for all kinds of credits and programs that higher income people don’t (including the ACA subsidies if you get your healthcare on the exchange). Plus compound interest starts working for you immediately no matter how small your investments are.

I honestly don’t care how much debt you have; most people should be saving and investing money simultaneously with your debt repayment, despite the fact that it will factually slow you down. This may look different depending on the type of and interest rates on your debt, but you should absolutely be saving, particularly if you’re a moderator.

Why should Moderators Be Saving While Repaying Their Debt?

Moderators are the type of people who view the occasional treat as motivation to continue doing something difficult. The way I’m defining the concept of moderation, this would mean padding your accounts while also repaying your debt. I’m a moderator, and I feel much less stressed about my debt when I have a stash of money waiting to be used in an emergency.

What are the benefits of “moderating” and paying off debt more slowly to build an emergency fund, retirement account or general investment account at the same time?

Most people have several years’ worth of non-mortgage debt to repay, whether it’s student loans, credit card debt, a car note, or something else.

Liquidity is the single most important thing to maintain if you’re in a job crisis, particularly if you’re single and don’t have a family fallback.

The main benefits of being a financial moderator come from working on multiple goals at once. Doing ONE major financial task for YEARS at a time is extremely risky because it relies on your constant employment and puts you in a precarious position in which you continue to rely on your current employment situation until all of the debt is repaid.

1. Investing now keeps you from leaving money on the table from employer matches in your 401k and starts the compounding process earlier, which is CRITICAL to building wealth, especially if you’re doing this #debtfreejourney any later than your 20s.

Has anyone seen the chart of what happens if you start investing regularly at 25 vs. at 35? Here it is as a refresher to reinforce my point: invest regularly early, no matter how little it is, because it builds on itself. And literally never give up free money from your employer. Reducing your taxable income while getting extra investment money? Yes please. Here are the two articles about people who started investing at different ages and different frequencies.

This is a woman who started at 25 and a man who started at 35. They invested the same amount annually until retirement. She came out ahead because #compoundinterest. Business Insider has a great post about various investor scenarios and in every single one, the earlybird does better, even when she saves for a shorter period of time and in some cases less money, period.

This woman started 10 years earlier and invested the same amunt monhly. She wins.

(Graph: Business Insider/Andy Kiersz)

Related Post: Saving For Your Future & Repaying Your Debt Shouldn’t Cost You Your Present Health & Wellbeing

2. Investing NOW allows you to take advantage of a huge variety of tax benefits, depending on what type of account you’re using to invest (401ks, IRAs, etc)

My salary is mid-100s but low enough I can get in the non-backdoor Roth zone if I plan it correctly. Every dollar I put into my 401k reduces my taxable income.

Lots of federal tax deductions, subsidies and credits phase out starting between $65k and ending at $135k….so not only are you reducing your taxable income for both state (if applicable) and federal taxes, you’re also putting yourself in a position to take advantage.

Here are some basic deductions/subsidies you can try to get by reducing your taxable income through retirement and other pre-tax contributions:

ACA subsidies: Financial Samurai provides info in this nifty chart

Roth & Traditional IRAs: I covered this in a post about How to Invest

Student Loan Interest Deduction: The Balance gives a good breakdown here

Probably lots more. I’m not going into granular detail here, but reducing your current taxable income certainly helps your financial situation because fewer taxes apply to you, and as such, you’re getting more of your paycheck working for you than if you forewent the 401k deduction.

3. Saving a 3-6 month emergency fund allows you to weather unemployment, underemployment, or quitting an absolutely hellacious job without jeopardizing your financial security, even if you are building the cost of monthly debt payments into your monthly expenses calculation.

I’ve been semi-employed and on the verge of unemployment. I LIVED on my credit cards and kept as much cash as possible on hand because I didn’t know how long I’d be in the situation and I didn’t have a fallback plan if I ran out of my cash stash. Frankly, I’d probably do that again if I had less than 6 months of cash reserves.

Liquidity is the single most important thing to maintain if you’re in a job crisis, particularly if you’re single and don’t have a fallback plan, and if you’re paying down your debt so aggressively that you aren’t building liquidity, you’re doing your future self a serious disservice.

Life is completely unpredictable and the thought of sending all of my money to my debt servicers instead of protecting myself against unpredictable financial disasters feels foolish to say the least. My personal experiences and credit cards giving me the ability to survive some pretty terrible times is why I NEVER advocate getting rid of your credit lines (even if you hide the cards and never use them).

Desperate times happen. Cutting off sources of liquidity/cash access is frankly stupid, in my personal opinion, not to mention that closing credit cards actually reduces your credit score (which you shouldn’t be trying to eliminate unless you’re going hardcore Dave). The Express and Bath & Body Works credit cards can surely go, but keep the other ones.

4. You can always refinance higher-interest debt so you aren’t paying 15% interest on your Macy’s credit card for 3 years.

Keeping your debt interest rates close to the average market return (5-8% depending on who you ask) will help alleviate some of the “losses” you will take from repaying your debt slower. If you can offset a good bit of the interest you’re paying on the debt with the returns you’re making in the market, it will make the whole thing a lot more palatable.

I’d definitely recommend going HARD on any debt with interest rates greater than 7-8% if you can’t refinance it, move it to a 0% interest credit card on a balance transfer, or otherwise minimize the accruing interest. But don’t blow off your savings completely if you’re taking the Moderator approach.

There are many other reasons to build your savings while repaying debt, and I only covered a few of them. Hopefully this gets you thinking about not only your personality and how it will relate to your overall financial situation, including aggressive debt repayment to the exclusion of all other priorities.