There’s plenty to complain about these days, and honestly, it’s getting kinda draining (name that musical!) so I decided to highlight one of the good things that has come out of COVID for me. Starting a new job remotely during the pandemic has actually benefitted me in so many ways versus going into a new office setting.

If you make enough money, removing the “added sugar” from your budget is a great way to free up money – guilt-free! – for things you just *want* to buy.

The onslaught of #2020Vision honestly overwhelmed me to the point that I didn’t even think about what I wanted from 2020 because I was too busy hiding from everyone’s new X-Ray vision.

This summer I replaced most of my workout clothes - I haven’t bought anything new in 6 years, which is crazy. Most of it was great quality, but a couple of the colorful leggings were quite see-through, which is NOT a lewk I’m going for. So a few hundred dollars will be going back in my account! I’ll call that a win.

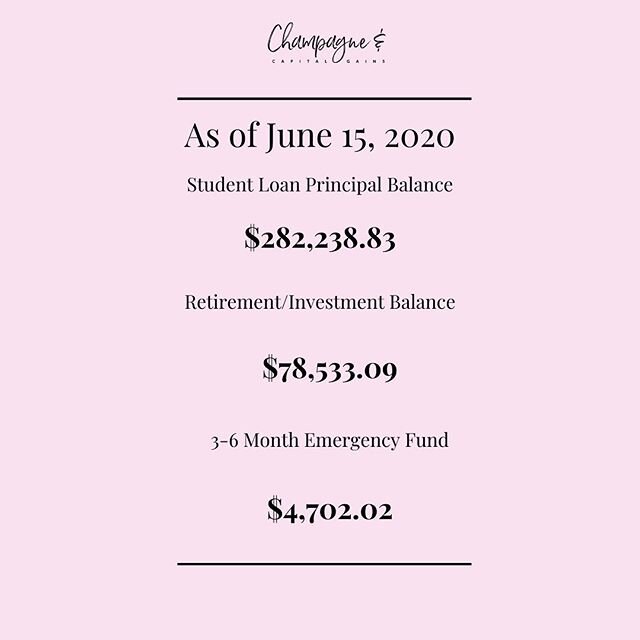

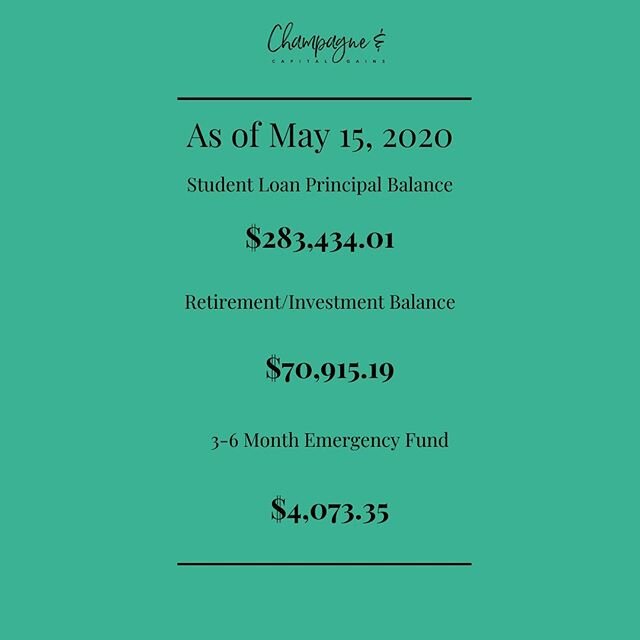

Yall, June was a monster. So much happened. I didn’t even post anything other than my May 2019 goals update last month because so much insanity was going on. And clearly July isn’t any less insane, because I’ve neglected the blog altogether. Sorry about that! But I’m back to give you the lowdown on how things are going in my money and my life.

I made a big dent in my consumer debt this month, but I did transfer some savings to do it because (A) I had a large payment due and I would have had to incur interest if I didn’t pay it…I also changed my W4 allowances because apparently I have had 0 withholdings since I got this job 2017. That’s crazy! Each paycheck is now ~$100 more, which means I’ve freed up ~$200/mo for reducing that consumer debt.

During our lunch, Beverly told me she couldn’t give me a job, but she was happy to talk me through the job search process and share with me how she made her decision on which firm to choose from among her several offers. "No firm/job/boss is perfect. There are going to be bad things about any job you choose. The most important thing to do before and during the interview process is…”

My consumer debt is finally *truly* on the decline, and as some of you may have seen in my Instagram stories last week, I’m almost to the point where I am finished with the “paying off each statement balance in a very particular order” merry-go-round. My reading list is still just as long as it was last month, because I’m falling down on the job.

While I haven’t accomplished everything I hoped to accomplish with the blog in the past year, I have certainly accomplished more than I thought I would in certain ways….and getting this thing off the ground imperfectly is a heck of a lot better than not getting it off the ground at all, amirite?

For me, there has been an undercurrent of anxiety and grief that is hard to describe…but essentially, it hasn’t left room in my brain for much more than the essentials and, in my downtime, relatively mindless entertainment.