High Five! Champagne & Capital Gains is Still Here After One Year!

/Champagne & Capital Gains is One Year Old!

So much has happened in the past year both on the blog and off. I don’t even know what to say. First of all, to those of you who read or subscribe or share my posts or follow me on social media, thank you so so so much!

While I haven’t accomplished everything I hoped to accomplish with the blog in the past year, I have certainly accomplished more than I thought I would in certain ways….and getting this thing off the ground imperfectly is a heck of a lot better than not getting it off the ground at all, amirite?

I mean, I’m going to give myself a high five if no one else will…which brings me to the theme of this post: high fives all around! Five categories with five things in each category to celebrate the past year and what I’ve learned in terms of money, life and blogging. The categories are:

Five Biggest Blog Accomplishments

Five Favorite Posts

Five Biggest Life Things

Five Biggest Money Things (This is a finance blog, after all!)

Five Goals/Areas of Improvement for Year Two (Blog and Life)

Without further ado:

Five Biggest Blog Accomplishments

1. Blog made its first income last month! (Thanks CocoJam)

This is actually a huge accomplishment for me! Another PF blogger used my affiliate link to make a few purchases, and my blog has now officially made some income from my Amazon Affiliate link. I have to make at least $10 to cash out, so if y’all wanna do some shopping, hit up this link! You too can get a shout-out in a future post :)

Long term, I hope to have a solidly-monetized business that includes the blog. Things like this are a small first step, but it means I’m moving in the right direction!

2. Rockstar, TFD, CampFIRE Finance and WomenWho Money Features

Probably the best moment of blogging so far was finding out I’d gotten my first Rockstar Finance feature while I was at FinCon hanging out with Jamie Griffin, Josh Overmyer, and Penny. It was one of the proudest moments of my life, and I got to share it with 3 fabulous humans. I did a happy dance in the Rosen Shingle Creek Conference Center while walking to the pool. It was great.

The Financial Diet also featured one of my very first pieces, and this was almost more exciting than Rockstar for several reasons. The Financial Diet was part of my catalyst to actually get my butt in gear with the blog. I saw Chelsea Fagan launch the site after leaving Thought Catalog and it intimidated me at the time because I’d considered starting a personal finance blog, but eventually it inspired me to *actually* do it because I knew I could. TFD publishing one of my posts proved to me that I was right. I did it and they recognized that what I did was good!

CampFire Finance and WomenWhoMoney also featured my pieces, which was thrilling. It’s always such a compliment when people read what I’ve written and like it enough to share it with their own audiences.

3. Spoke at my first conference, Fiercelab, as an Influencer!

One year ago, I was an online nobody…and now I’m signing contracts as an “influencer” - this is incredible to me. While I’m not selling thousands of bottles of Sugarbear Hair or convincing you that YOU NEED THIS FitFabFun box (really, this season’s box, you need it, I promiseeee…jk), I have been able to meet with people and speak to them about money and what drives my own financial decisions.

Fiercelab was an awesome, one-day conference held in Dallas that brought in 10-15 influencers from all around the country to speak to women on money, personal growth, and even negotiation tactics. They even offered interactive workshops during the afternoon, which is what made it a “lab.” Tara Wilson’s agency put on the conference themselves after wishing for years some of their clients had wanted to do a conference like this.

I got to speak on the money panel with Lindsay Perez from The Financial Gym, and we had TONS of amazing questions from the audience. I don’t really consider myself “an influencer” truly quite yet, but the coolest part about speaking was having people approach me afterward with follow-up questions or thanking me for sharing my outrageous student loan debt numbers or to tell me a tip I gave resonated with them.

That’s what influencing is about to me: telling my story or giving advice from my point of view and hoping it resonates with my audience, no matter how large or small it is.

4. Embedded myself in the PF community and making tons of legitimate friends/building a business plan

Truly one of the greatest things about my first year blogging is the number of real friends and solid acquaintances who have free-fallen into my life in the past 12 months. I think back to the time when I didn’t know all of the personal finance bloggers out there, and I cannot, cannot imagine going back to that time. What was that?

When I found out my mom was sick in particular, the Personal Finance community rallied around me and helped me through the worst of it. Angela sent me Chick Fil A gift cards for my mom, people check up on me constantly, and my family has felt ALL the prayers & support.

FinCon was a BLAST. Literally no one knew what I looked like, so I dressed like my avatar for the first day to see if people would recognize me. Josh and Lisa DEFINITELY won the day on that one, as well as Liz.

Bridget Casey and I met when we were both in the same city once, and now we’re basically BFFs. Planning a trip to Vegas this summer when she will be a sugar baby and I will be a puma (future Cougar).

Stefanie O’Connell let me stay in her hotel room for FinCon which meant I also met Emma Pattee. I met The Financial Diet Team. Emilie, Stephonee. StopIroningShirts, PFGeeks, Tori Dunlap, and SO MANY MORE. I can’t even begin to touch on everyone.

But know that this community is for real. It’s not perfect (nothing is), but it’s a bunch of beyond awesome humans and I’m grateful to know you all. It’s probably the best part of having started this blog if I’m being completely honest.

5. Those Pageview, Follower and Subscriber Numbers!

Again, I’m thrilled to hear when my posts influence anyone’s life and/or finances in a positive way…but knowing that thousands of people see my content on a regular basis is just *wild* and exciting! These were my annual pageviews and individual visit numbers from Squarespace:

20,000 views! Whoa.

Additionally, I’ve surpassed 1,100 Instagram followers, I’m closing in on 2,800 Twitter followers (follow me! I’m funny!), and I have 130 mailing list subecribers! Seriously, that is bonkers to me. I’ve said it already today, but I’m so grateful for each of you and I hope you stick around as I ramp up with more content this year :)

Five Favorite Posts

Presented without individual reviews here. These are my absolute favorite pieces because they hit on a lot of what I really care about in life and with money: arranging your budget in such a way that you prioritize taking care of yourself in healthy ways, not giving into fad ideas like minimalism if it isn’t your thing, and cultivating meaningful relationships while you’re on your financial freedom or life journey. Here they are! Would love to hear which posts were your favorites in the comments.

You Need Emergency Friends Just As Much As You Need Emergency Funds

Minimalism is Not a Virtue

When does Self-Care become Self-Sabotage?

Mental Healthcare Costs Should Be Non-Negotiables (or, All Y’all Need Therapy)

Why The Fitness Line Item in Your Budget Should Hurt (or, Pay for Your Damn Workouts)

Were there any favorites of mine that you missed? If you’re a blogger, I’d love for you to post some of your favorite posts of your own for me to read!

Five Biggest Life Things

1. Mom has cancer.

This was the shock of my life. Truly. I wrote about it here. Her diagnosis was sudden and her treatment has been intense. Overall she’s had a pretty “easy” time with it: no infections and her side effects from chemo have been on the milder side.

She’s finished with all of her initial chemo treatments and is in remission, but now we have to decide if we want to do a transplant. We only have half-matches for transplant, so we aren’t sure what we’re going to do. If she doesn’t relapse, stopping at chemo is WAY less risky. But people who do transplants and don’t die from them have a much, much lower rate of relapse. It’s a parade of shitty choices, I tell ya. But we’re trusting that the decision we make will be the right one.

2. Starting to legitimately like practicing law

Y’all. This is a big one. I haven’t talked enough about my journey to legal practice, but I hated my first couple of legal jobs with the fire of 10,000 suns. The work sucked. My bosses sucked. My coworkers didn’t suck, actually. The pay didn’t suck either, but sometimes no amount of money is worth the misery.

When I left BigLaw in late 2017 for my current firm, it was a risk. I was taking a huge pay cut and moving from debt finance (lending) practice to commercial real estate, for the most part. I’d done a ton of real estate-backed lending (think someone buying property with a loan…like a mortgage but in a commercial context), but I hadn’t done *true* real estate practice, which is leasing, buy/sell, development contracts, etc.

A little more than 18 months ago, I started to work for my boss and to learn leasing. It was a complete change of practice area, and that’s an uncommon (but often-desired) opportunity for a young, midlevel attorney to find. I’ve been learning from my boss ever since. He’s smart, ethical, patient, good-natured, and overall very enjoyable to work for.

I don’t dread the work itself and I don’t dread coming into the office 95% of the time, aside from those inevitable days I want to veg at home and never work again…but I mean only about 5% of my workdays are super stressful because of my job or work environment. And it’s a type of stress I can weather. Figuring out what stresses you can weather and what stresses you cannot is an important thing to learn about yourself.

And, more interestingly than anything, I not only don’t dread the work, I’m starting to enjoy the work on occasion. This, I think, comes from my increased proficiency at lawyering. They say passion comes from mastering something, and I’m starting to believe that there’s some truth to the idea that becoming more competent at anything makes it more enjoyable than when you suck at it and feel like you’re drinking from a fire hose for several years.

Anyway, enjoying my day job kind of…plot twist!

3. So much travel I got airline status for 2019!

Last year I initially received Platinum status with American Airlines through a FoundersCard promotion, but I had SO much travel last year (multiple international weddings and international trips, a visit to Hawaii, last-minute trips home, FinCon, a couple of work trips) that I earned full Platinum status for the year ON MY OWN!

This isn’t the first time I’ve mentioned the status, but it’s super awesome to have. Once you fly with all the extra perks, it’s really hard to go back. Free checked bags, upgrades, priority boarding, you name it! You also earn more points when you fly, so the travel rewards are even faster when you have status than when you don’t. To be perfectly frank, I’d prefer to fly Delta, because their program is better and American has devalued their program this year/made it more difficult to get status, but I don’t live in a Delta hub so there are very few flight choices for me compared to American.

Here are some travel highlights!

4. Moved in with a roommate and overall loving it

When I started drafting this post a few weeks ago, this was totally true. But the Lord is testing. me. on this one right now, y’all. TESTING ME. We’re doing 6 weeks of major renovations, which I knew would be happening at some point when I agreed to move in with my roommate, but I didn’t know how extensive they would be or that it would involve a second roommate in the house (another friend of ours who I do just love). But renovations are disruptive and y’all KNOW I hate being disrupted or inconvenienced. Pray for me.

That said, I have enjoyed having a roommate overall for a lot of reasons. It’s nice having another person around and we get along really well. We do some social things together, but not everything, and there’s a good balance there. We plan parties together and chat about life. We share some house costs! She watches the dog every so often. I am helping to domesticate her. It’s a win-win for everyone.

The harder parts are actually good too: learning to compromise with another person. Compromise and conflict are two of my least favorite things. I don’t like getting walked all over and historically that has happened to me often. Living with a roommate inherently requires you to be inconvenienced or displaced on occasion, and I’m building my “having a roommate” muscle slowly but surely.

5. Life is in equilibrium overall - can focus on the areas where it isn’t (faith, dating…hooboy)

Besides my mom being sick (which I don’t consider “my life” for these purposes), my life is generally rocking along at a steady pace. I have a roommate I like, a job and boss I enjoy overall, my mental and physical health are in a good maintenance rhythm, and I don’t have any currently major crises. I do have to get my bridge replaced (the fake tooth), which will be expensive, but isn’t super traumatic or stressful.

That leaves my dating life and my faith. All things I haven’t been maximizing in the past year…which was intentional last year. As you recall, I was basically lighting dollar bills on fire last year to get my mental and physical health in check. Everything I did last year was beneficial to me and most of it was a necessary precursor to putting effort into my faith and dating. But now, I have more capacity to do it, because so many other things in life are calm and steady. Now is not the time to remind me of the major renovations happening at my house.

Faith is never static, and you can always be learning, but I’ve neglected to find a church and get plugged into a group there, which is something I have been wanting to do. To be honest, I haven’t felt motivated to do it since I’ve been back in my current city and I’m just now coming to that place. I needed a break to regroup and reevaluate my values so that I could better decide where would align with those values.

Anddddd then there’s dating. The bane of my existence. I went into this year with the attitude that “I will not demonize the boys!” - and while I still have that attitude, I’ve met exactly ZERO men I have been interested in dating. There’s a guy I dated last year who doesn’t live where I live who keeps popping into my head, but since I met him last April and stopped seeing him last June (due to him not being able to relocate anytime in the near future), everyone I’ve met has been almost completely uninteresting to me on a romantic level.

So many good stories. I need to do more Instagram dating highlights for y’all because there have been some good ones. Just not actual good ones in the sense that we are compatible and mutually attracted. I’ll keep trucking on this one, but just know: It is not in equilibrium and I hate it and I want it to be done.

Five Biggest Money Things (This is a finance blog, after all)

1. Hitting $50,000 across all investment accounts in 2018

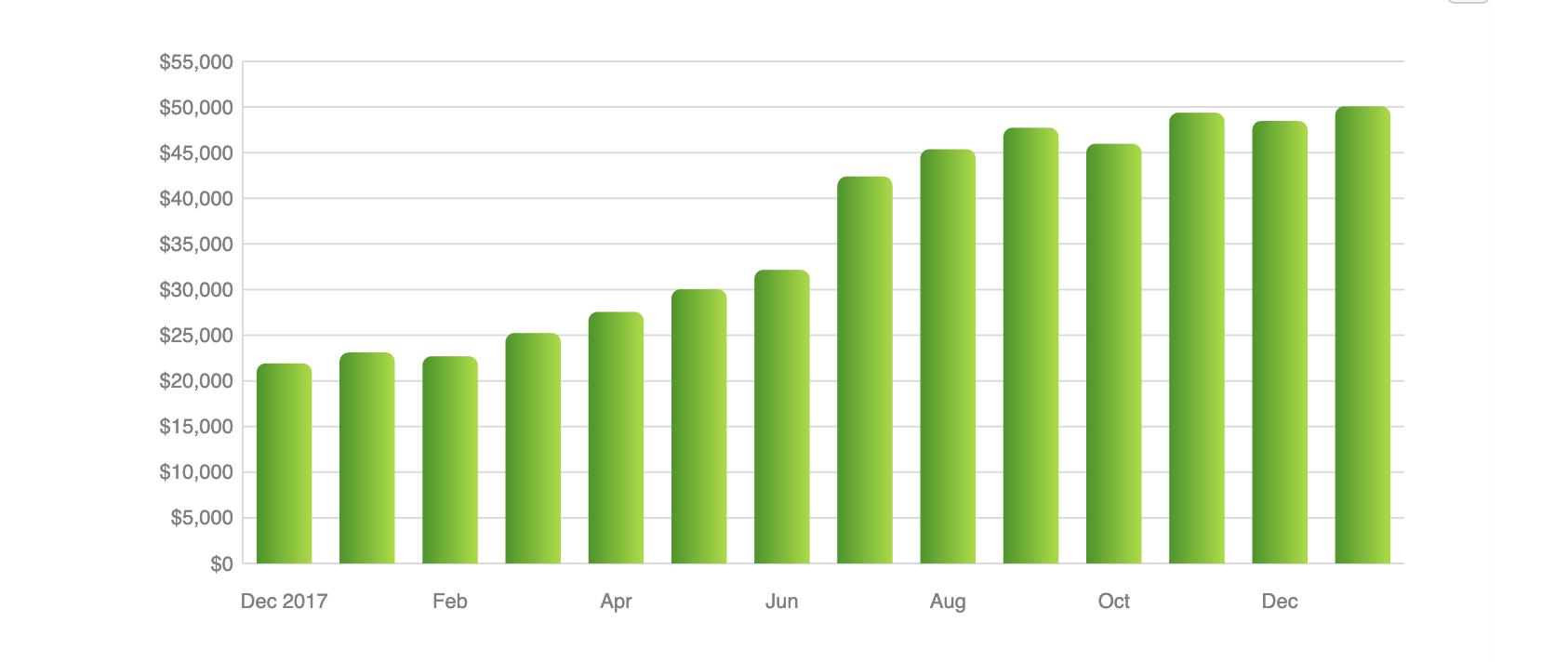

Last year, my goal was to hit $50,000 across all of my investment accounts. In early December, I reached my goal! It quickly dropped back down below $50k when the market corrected, but here’s a graph of my TOTAL savings and investments at the end of 2017 vs the end of 2018:

December 2017: $21,916

December 2018: $50,074 (January bar includes 12/31 401k contributions)

That is staggering to me. I went from $21,000 TOTAL saved from August 2014 when I started my first job out of law school to December 31, 2017. That’s only $7,000 per year for 3 years, folks. Last year alone, I saved almost $30,000 *while repaying student loans* and it frankly didn’t even hurt that much (though I did end up with some random credit card debt at the end of the year, so maybe it did in other ways…fortunately the CC debt isn’t accruing any real interest)

I’m proud of what I accomplished in this area in 2018 and I’m building on it in 2019!

2. Student Loan principal balance under $300,000 (OMG KILL ME)

My high student loan balance was $309,000. A lot of that was interest that capitalized once I (finally) refinanced all of my loans. I was negatively amortized for 3 years as I’m sure you’ll see me mention a lot. My overall debt load from law school was around $225,000. I also had $35,000 from my master’s degree and a TINY study abroad loan. The rest was interest that accrued during law school or deferral and negative amortization.

Anyway, I finally refinanced in late 2017 and started paying down my student loan balance. Last year, I got under the $300,000 mark and I’m working towards $290,000 right now! With all of my other financial priorities, I’m not paying much more than the minimum payment (which is insanely huge), but I’m hoping to change that within the next year. Progress is progress, right?!

3. Car loan no longer upside down

For the first time in my adult life, my car is worth more than the outstanding loan balance! I’m not upside down! Hooray! It took a bit longer than I wanted, but I did roll some upside down value from my last car into this loan AND paid for the extended warranties in the loan. I drive a Jeep Grand Cherokee, so the extended warranty was *necessary* and worth it.

Anyway, my car payment is stupid. But my insurance keeps decreasing, and I’ll at least have equity in the car moving forward until I repay the entire loan. Hopefully sooner rather than later! I put all extra income this year toward the principal of the car loan until the loan value was under estimated value of the car.

This is the last car payment I will ever have (so help me), and it’s the car I’ve always wanted, so I’m fine with it. All of my decisions were calculated with the full picture in mind. But friends, countrymen: PLEASE avoid rolling old car loans into new car loans unless you have an EXTREMELY extenuating circumstance, ya hear me???

4. Maxed out 401k for 2018

5. Convinced my law firm to pay associates 10% of any client fees they originate

This is something I’m super proud of. I had real estate banking contacts at a big litigation client of ours and I proposed to the partners that if I brought in a completely different group from this client, I should get the origination credit and fees on any work coming from that group.

I got a little bit of pushback on the firm giving ANY origination fees to associate, whether they are a completely new client or a new group within an established client. They argued that bringing in clients was a part of an associate’s salary and that we shouldn’t get extra pay for it.

This is a new firm, though, and the older firm my firm left gave associates 10-15% origination fees on clients. A couple of associates who moved over from the old firm when our office opened already have this arrangement with the partners for their clients. I reminded my boss of this, the partners voted, and they agreed that all associates will receive 10% origination fees on any client they bring into the firm. The partner who originated the large client I may eventually get business from has also said he has my back on comp if that happens.

THIS WAS BIG. I got pushback. I provided data and reasons why I should receive a commission on new groups from old clients AND on any new clients I bring to the firm. And the firm made a decision confirming my request! Wa. Hoo.

Five Goals/Areas of Improvement for Year Two (Blog & Life)

These mostly speak for themselves, so I won’t write long paragraphs about my future goals! I’ll just dive on in!

1. Cover my blog expenses (including FinCon) with income from the blog.

2. $75,000 across investments and savings accounts by the end of 2019

As of writing, I have ~$64,975 saved and invested with a *minimum* of $10,450 set to automatically be saved by the end of the year. I’ll hit this goal. I might need to increase it!

3. Finish designing my subscriber freebie so I can roll it out and build a solid e-mail list (hint: it’s in the name of the blog and will be FUN).

This is coming in the next 2-3 weeks, so get excited! If you don’t subscribe to my e-mail list, now’s the time:

4. Structure my blogging time on a weekly basis so that I’m consistently producing content and moving the business forward.

5.Run a half marathon again.

I’ve spend the last ~20 months getting my body back into fighting shape, and that has largely excluded running. I’m not a HUGE runner, but I enjoy a good running challenge, which is the beauty of the half marathon. It’s difficult enough to feel like an accomplishment, but the training and event aren’t *actively bad for your body* like a marathon is (sry marathoners, truth hurts. So do your shins, I imagine…).

Running has been painful for my knees for awhile, and I believe I’m now at the point where I am strong enough to start building my running legs again. I’m eyeing one in December, so I’ll keep you posted! This is actually a big goal, but I think I can do it!

Year 2 is in full swing (even if my posting schedule doesn’t show it yet).

What would y’all like to see on the blog this year? I have some reader request posts coming, and always open to ideas! Share in the comments :)