April 2019 Goals Update!

/April was a whirlwind! My last wedding was the first weekend of April and besides some hot mess airport issues, the weekend was fabulous and now most of my BFFs are all married off! Pretty crazy and exciting!

We had a little bit of drama at work involving billable hours (they are trying to impose strict, daily time requirements…which is completely inapposite to attorneys’ positions as exempt professoinals). Nothing grinds my gears more than petty time entry requirement when the expectation is that we’ll work 12 hours without overtime if our work requires it. The flip side is supposed to be flexibility on slower days.

ANYWAY. The partners at my firm get *really* into things for a couple of weeks and then they kind of drop it, and fortunately that’s what happened with the hours situation. So while it’s stressful for a couple of weeks, it always goes back to normal. And that’s what I need in a job.

So how did I do on my goals this month?

(1) Spend less money & repay most of the consumer debt

My consumer debt is finally *truly* on the decline, and as some of you may have seen in my Instagram stories last week, I’m almost to the point where I am finished with the “paying off each statement balance in a very particular order” merry-go-round. After May, I should be able to rapidly decrease my consumer debt because all of my extra money will be going to current expenses and debt repayment rather than chasing statement balance payoffs.

Reduce my dining, grocery, travel and shopping expenses.

My entire trip to Paris has been booked on points so far! That’s $1600 of airfare and hotels that I didn’t have to pay for. So I guess I’m doing ok on the travel expenses, since nothing has been out of pocket in the past month.

Dining has been pretty bad lately. Every time I go out, I feel like I spend $50-100 on food and drinks. Last year I averaged $417/month on groceries (excluding Target, but that kind of evens out the fact that my grocery category includes any household goods like paper towels and shampoo, which Target mostly includes). As of the end of April, I averaged $274/month on groceries, so that’s an actual, measurable improvement over my 2018 grocery spending!

Last year, I averaged ~$500/month on food and drinks out, which is only an estimate because I’m often one of the payers on big trips, and it’s hard to separate that on Mint, so I just decreased the total average by enough that I feel like I have a good eating out estimate. Remember, I’ve mailed it in on tracking EVERY expense for 2019, so this is the best I can do.

This year so far (again, estimating based on being the payer on at least 2 bachelorette parties), my food and drinks spending is ~$540/month, which is a little bit more than last year, but a LOT of that was bachelorette parties, and I’m finished with weddings for the year so things should calm down (minus the Paris trip).

Overall, I’m down in my average spending when you add the two dining + grocery categories together compared to my average spending last year, and that’s a win in my book! Definitely working to temper the restaurant/bar spending, though. Yikes. $500/month is a LOT of money.

Accept all somewhat reasonable Poshmark offers.

Ugh, again, I tried to negotiate a low offer that would have fallen into this “somewhat reasonable” category, and I lost the sale. I did sell several pairs of shorts as a unit that I’d been trying to sell individually for years, so that’s exciting! Bundling seems to be a successful way of getting rid of things that are hard to sell as single items.

(2) Build the blog (including monetization)

There are a couple of exciting things in the pipeline for the blog in the next few months, and I’ve started adding occasional ads in posts and the sidebars. Nothing too distracting for you guys, hopefully! I promise to NEVER have a website that looks like Reality Steve’s, though (love you, RS, but your site is not designed how I’d design a site! So many pop-up ads…)

(3) 50 Blog Posts

This is my 10th post for the year and we’re one-third of the way through 2019, so I’m not “on track,” but I think I’ll be able to ramp it up over the next few months to bring 50 within reach by the end of the year!

Related Posts: 2018 Was the Year of Mental & Physical Fitness; 2019 Is the Year of…

(4) 30 Minutes of Productive Screentime Daily

This has improved a lot since last month. I haven’t missed a day on Givling, which is important because my long-term strategy is to end up at the top of the queue at some unknown future date simply by playing consistently enough to jump other people.

Duolingo put me in some kind of competitive league that advances on a weekly basis, so I’ve done SO much more French in the past month than in any month prior. Some of the lessons are too easy, and the practice lessons I get can be too hard. Not sure what’s going on with that, but I’m definitely refreshing my French skills! Also, anyone know the difference between “les” and des” because if so TEACH ME NOW.

Finally, I hopped back on the dating app and have been making a little bit more of an effort to respond to messages and match with people. Hopefully one of these days a date will work out for me. Until then, expect more cynical dating comments :)

(5) Fewer than 5 hours/week of TV (except football season/sports)

Eek. This has been a failure the past few weeks. I’ve been bingeing NCIS and Law & Order: SVU. In my defense, my allergies have been so bad I can barely move sometimes on the weekends, so it’s mostly been a result of not feeling so hot and not having the mental or physical energy to do much of anything else.

Bachelorette is also premiering next week, so that will be back in my rotation. I need to lock it down on the crime shows and documentaries.

(6) Read 12 books

Still reading Walking With God Through Pain and Suffering by Tim Keller. All the TV I watched in the past few weeks that I shouldn’t have has really kept me from moving the ball on this one. I used to read so much! I’m embarrassed of myself.

(7) Finish The Federalist Papers

No progress. But I have a lot of flying in the near future, which is where I do a lot of my Federalist Papers reading

(8) Walk my dog more (specifically: around the block almost every day at least once)

I’ve been doing a lot better with this one! My boss has been coming in very late or not at all lately (we have good remote work capabilities, which is nice), so I haven’t felt as rushed in the mornings. The better weather and later sunsets have made this more palatable in the evenings. I usually try to do Duolingo lessons while I’m walking him because #multitasking

(9) Work out 200 times this year

I worked out 12 times in April, which was below what I needed to stay on track, but I’ve gone 5 of 6 days in May as of writing this post, so I’m hopeful I’ll get back on track. When I work out more, I just feel *so* much better. Total right now is 60 workouts for the year. I can definitely make up ground!

(10) Go to church 12 times (and preferably commit to one)

Definitely haven’t gone any more than the 2 times I’ve already discussed in previous goals update posts, so I need to step up on this one. It’s due in large part to travel, though.

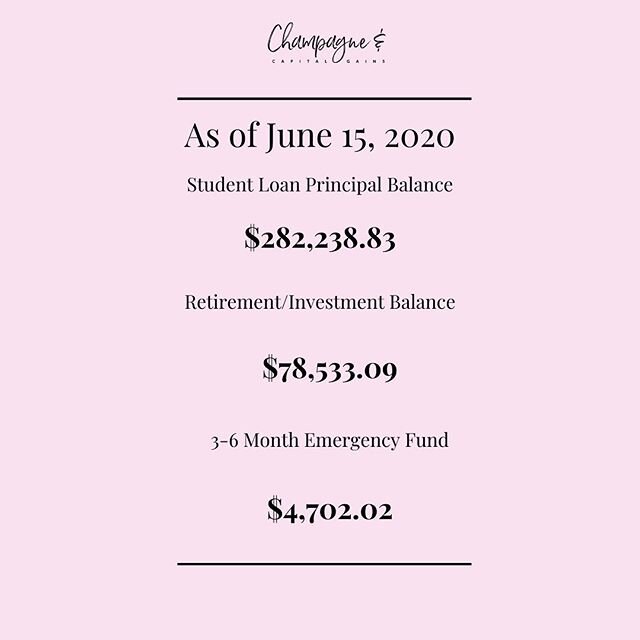

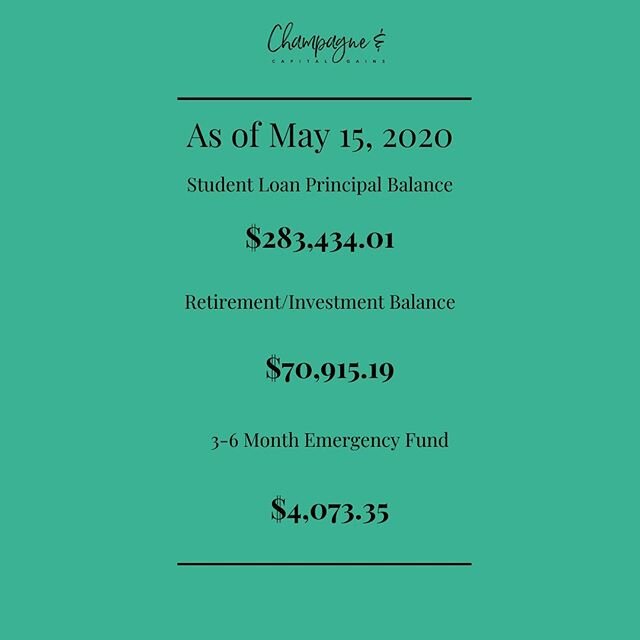

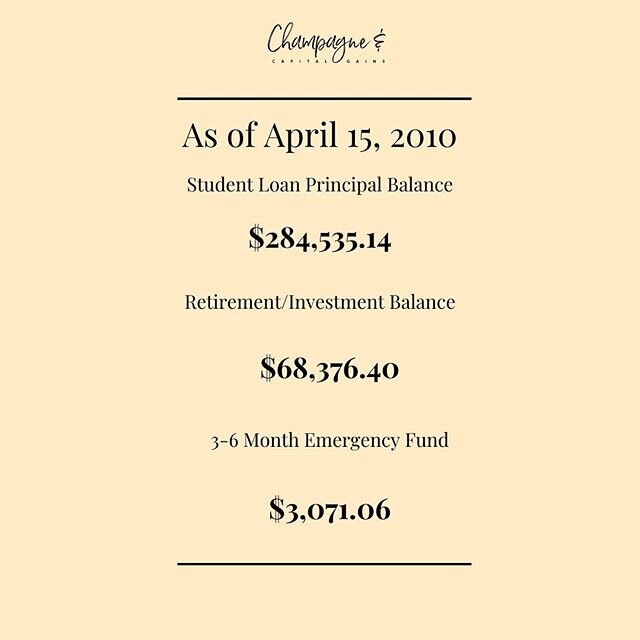

(11) $5,000 in Emergency Fund

Currently sitting at $3,935.57, so I’m closing in on $4,000! Again, dental work will take a bite out of this, but I should be able to recover it within a couple of months.

(12) 1-2 new dates per month (unless I meet someone)

Last month I went on dates with two new guys - one who I mentioned in my March recap who was a case of false advertising. He tried to meet up again and I was busy visiting friends out of town, so my responses trailed into an accidental ghosting. I hate doing that, but it happened. He then resurfaced this past weekend asking what my plans were, and I just...I can’t.

A couple of weeks ago I went out with a guy who seemed cool and fun before I met him. He planned ahead, we went to his favorite taco place, and I liked talking to him. But nothing was *there* for me. He also wore sweaty gym clothes on the date, as he’d just come from intramural something-or-other...which is just not a great first impression. Nice guy, not for me. Which frankly is an improvement over the last two, so hey - we’re moving in the right direction! And I’m not giving up no matter how much I want to, which is the important thing, right?

May’s Gonna Be Expensive

This month I’m traveling home to visit my mom and get my tooth things taken care of, which I’m estimating will cost ~$2,000 (it will probably be less, but I’m keeping that benchmark in my mind so that anything less than $2,000 is a pleasant surprise!) - the second part of the tooth/bridge repair work will happen in June, but I’m assuming I’ll have to pay for it in full when the first procedure happens.

Then of course there’s Paris, which I’ve mentioned a couple of times, but I’m hoping I’ll be able keep spending pretty low since the trip is only 4-5 days.

And finally, I’m perpetually behind on gift-giving, so I need to get birthday and wedding presents squared away for all of my friends because I’ve done exactly 0 with that.

What do you guys have going on in May? Is it going to be expensive with the end of school or travel plans, or are you sticking close to home and saving money?!