Why the Fitness Line Item in Your Budget Should Hurt & How Much I Spend on Fitness

/Saving for the Future and Repaying Debt Shouldn’t Cost You Your Present Health and Wellbeing Series: Part II

Ohkayyyyy y’all. You ready for me to challenge some common financial advice? One of the things I see and hear often in the budgeting and personal finance world is that eliminating gym memberships in favor of free or less expensive fitness options is a Great Way to Save Money™ and Something You Should Do™. People constantly agonize over whether keeping their memberships is poor stewardship of their resources.

I am here to tell you that this is not bad stewardship, and even less so if your current gym membership does not cost enough to induce your use of the membership, or if you don’t work out as often as you want to or should. IT’S OPPOSITE DAY! So how much should I spend on fitness?

People (Usually) Use Things That Cost Them a Lot of Money

If you are self-motivated enough to run regularly, strength train in your apartment gym or living room, and go all-out on your yoga or other workout video each morning, MORE POWER TO YOU (How? Why? I put you in the same mystical category as Natural Morning People. You are anthropological mysteries to me…). You don’t need this post. If you never have and never plan to work out, this post is also not for you (please instead Google “Why you should work out regularly” #yrwelcome).

But for the rest of us, gym/studio memberships are pretty much the only way to guarantee we sweat hard on a regular basis. I have found that doing exclusively free exercise works for very few people, myself included, either (1) because it is easy to just not, or (2) if you do, it is easier to slack, because no one else is watching, or doing it with you, or encouraging you to do your best. Therefore, telling people who already do not work out enough, despite having a gym membership, or who currently have a good fitness routine going at their gym, that they should cancel said membership and work out on their own to save money, is frankly irresponsible if your goal is anything other than Financial or Debt Freedom As Quickly As Possible No Matter What It Costs You Personally. Which, as I’ve noted before, is not the ideal way to repay debts.

To me, taking care of your body is the most important and ultimately beneficial part of any financial journey; thus, the cost of doing so outweighs any current savings you may gain by eliminating your gym membership bill. If things feel expensive to someone, that person is behaviorally more likely to try to max out the value of that product, at least in my personal experience and that of most of my friends. So unless you simply aren’t motivated to use by the costliness of a commitment, you should feel your fitness commitment in your budget to see improved fitness.

My Fitness Costs Hurt and It’s Working

I’ve always been somewhat consistent with exercise. Besides the couple of times I’ve had surgery and wasn’t allowed to work out for a few months, I work out – at worst – once per week on average. I can’t remember the last time I went more than a week or so without a single workout of any kind. But I’ve never been consistent, ongoing, and building my strength and fitness over a very long period of time. It comes in bursts, and that just isn’t what I want for my life. I want fitness to be a part of my life, full-time, forever.

About six months ago, I was in slumpiest of fitness slumps, but I wouldn’t admit it to myself. Then I pulled a muscle in a yoga class doing something very basic, and I sought out a trainer to help me diagnose it. I realized I was WEAK. My trainer told me nicely that I was just “slightly,” but he was giving me way too much credit. I was so weak I couldn’t make proper fists, y’all. Grip strength is a major indicator of overall health and I was failing big time. I decided I wasn’t messing around anymore. I am a member of a v bougie gym (Read: not cheap, but the bath products are legit and TBH I have actually recouped some of the gym costs by showering there after workouts) with top-tier personal trainers (Read: very not cheap), and I know that the prospect of losing money for something I paid for and didn’t attend is the most motivating factor to me for anything aside from knowing someone is waiting for me at a workout class and bailing on them.

So….I signed up for personal training. First for 18 sessions, and then I re-upped for 36 more. It’s almost time to re-up again and I will do so without question, because it is worth it.

My trainer is self-assured, as he should be, because he’s a badass trainer, and he told me that if I gave him enough time, I’d start seeing results both in my body and in other areas of my life. Y’all, he was so right. After a couple of months of two mornings per week, I started to see slight changes in my body shape and noticeable changes in my strength. Now I’m doing leg presses over 100lbs and using 15-17.5lb weights when I do arms. That may not sound like a lot to some of the guys reading this, but if you think I don’t feel like Atlas-in-training, you’re super wrong. It’s empowering. I can make fists. I have more energy. I beginning two mornings per week more productively and earlier, including office arrival time. I’m working out more often outside of training. I haven’t necessarily seen financial gains in my professional life yet, but this blog has finally manifested since incorporating personal training into my life, and it’s possible the two are related.

I haven’t necessarily seen financial gains in my professional life yet, but this blog has finally manifested since incorporating personal training into my life, and it’s possible the two are related.

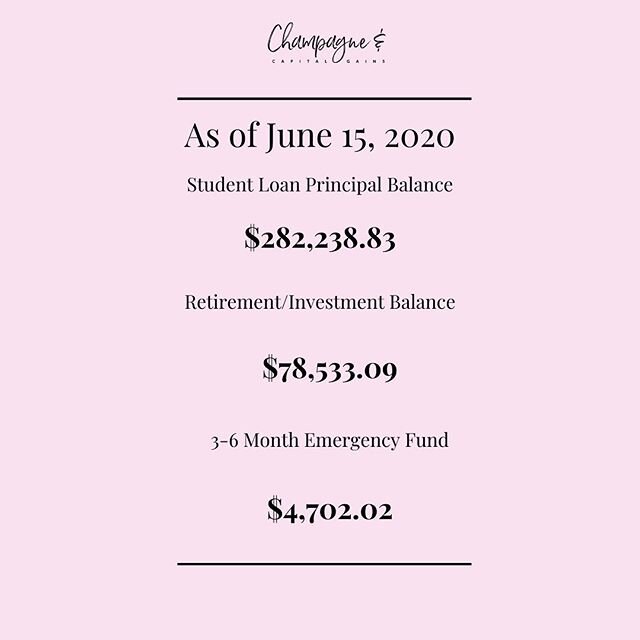

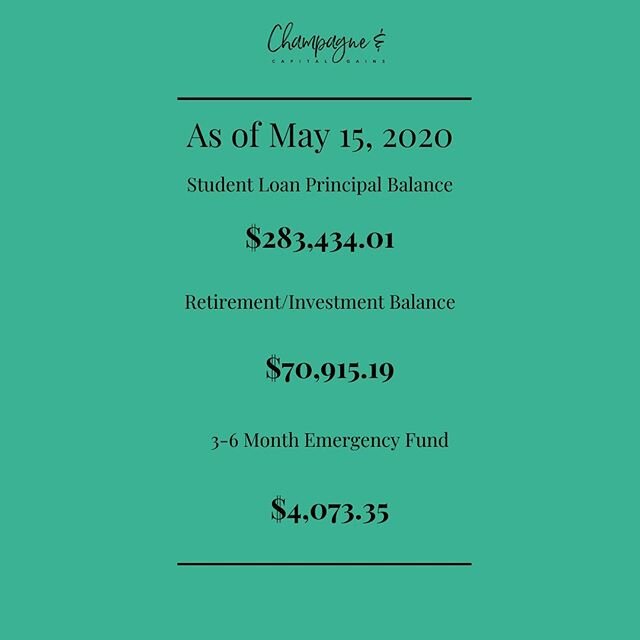

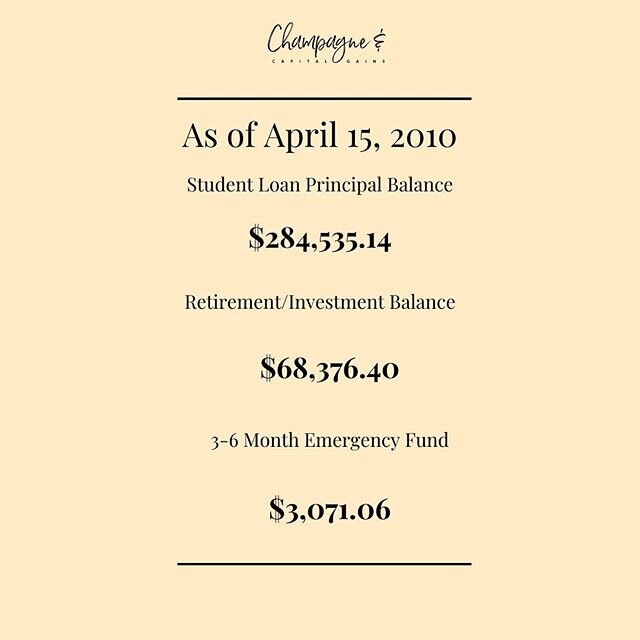

I am paying a TON toward student loan debt each month, but I am also paying a TON for my gym membership and personal training, and to be honest, I don’t even think twice about it because the benefits are tangible and only increasing over time. Here’s what I’m spending:

Membership: $157 (I receive a discount through a small business membership I have; normal price is $173)

Personal Training 2x/week: $92/session: $736

Total: $893/month

That is SO much money. But it is worth it to me because it is improving every area of my life so significantly. When you feel better, you work more efficiently. Mental health improves, if that’s something you have to consider (P.S. this week’s later post is about mental health costs!)

Now. I will say that I have cut my discretionary spending in other areas since incorporating training costs into my budget. In the past 4 months, I’ve only purchased a pair of leggings and two undergarments, which is nowhere near my normal clothing spend. I gave up my cleaning lady for a month to see if I could do it (#neveragain), I canceled Netflix and a couple of other unnecessary subscriptions, and I have been watching lunch/coffee purchases much more carefully. Technically, I could pay for all of this (except training + lots of shopping, thx Sallie Mae), but it would slow my debt repayment to do so. I am absolutely prioritizing fitness and debt repayment, so new shoes just have to wait awhile.

If the cost didn’t hurt, I wouldn’t be nearly as motivated. And you truly get what you pay for in the way of personal trainers. At first I resented spending almost $100 to be tormented for an hour, but then I remember people pay my firm like, $350/hour for me to move commas around and I started to value his expertise at that price (and I see ~1/5 of that money). Comparatively, training is a steal!

So now that you know how much I spend on the gym, why, and how it’s benefitting me....

A few suggestions for how to (guiltlessly) refuse to eliminate fitness costs from your budget in the name of #FinancialFreedomFaster and get more fit in the process:

People Who Have a Gym Membership and Use It

Basically, if you have a gym membership you use and like, DO NOT CANCEL IT. Figure out a way to keep that sucker in your budget. I don’t care how. Side hustling, working overtime for a few hours, or cutting back somewhere else is always worth it if the alternative is upending your current fitness routine and relying on your own willpower and some Jillian Michaels videos to save like fifty bucks a month. I’m here to tell you it’s not worth it to cancel and in a month or two, you’ll probably notice a difference in your body/mind in a bad way. You hear me @FinanciaLion? Don’t cancel your Crossfit membership! Or maybe do, because ugh, Crossfit. Jk, keep on keepin’ on.

People Who Have a Gym Membership and Don’t Use It Enough (or At All)

Ready for some counterintuitive budgeting information? If you pay for a gym membership and you rarely use it, find a more expensive gym or fitness studio and sign up for that. Or add personal training to your routine. Class Pass is a great option as well. You can sign up for different tiers of membership ranging from about $50/month to $200/month and it gives you all kinds of studio fitness class options around town to choose from. If you sign up for a class and don’t show up or cancel last minute, you get charged $20. That’ll get you outta bed and onto your yoga mat, right? RIGHT?! If not, I think we need to pray.

People Who Don’t Currently Work Out But Want To

Join a gym, even if you have a free fitness center where you life. If you can afford somewhere like Equinox, DO IT. Other good options are OrangeTheory, LA Fitness, Gold’s Gym, the Y, barre studios, cycling studios, etc. Join the most expensive (and legit; don’t pay a lot for nothing, obviously) gym you can afford that you think will induce you to get up and go. Look at their class/training cancellation punishments to see if it will get your butt in gear. Or join a gym your friends also use, regardless of price. Strength in numbers!

Tailor Cost to Your Budget

Your spending on fitness should, in my opinion, be uncomfortable enough in your budget that you need to reduce spending in some other areas to compensate. I do not expect all of you to be able to spend $175-250/month on Equinox. But scale the cost of gym membership to your salary in a way that will motivate commitment. So if you make $60,000/year, Equinox at $175-250/month or OrangeTheory/LA Fitness at $89/month + a few training sessions or outside yoga classes for another $150-200/month might be realistic numbers. Six-figure earners, you can spend what I do depending on your other debt levels. If you make $30,000, that $30 Gold’s Gym membership will probably have the same effect on your bottom line and also your bottom ;) Plus, Body Pump at Gold’s/the Y whipped me into shape in college/law school.

Consider the Money You Save By Being at the Gym Instead of Somewhere Else

You know where you aren’t if you’re in a workout class? Happy hour. Sleeping in until 30 minutes before you’re supposed to be at work and then having to Uber to your office instead of taking public transit. Online shopping. Mindlessly eating. Track that for a couple of months after you install your new fitness routine and see how much you are saving (along with the reduction in grooming supply costs if you regularly shower at the gym)!

Not everyone is motivated to a fitness routine (or anything in life) by its cost, but a lot of us are. As with the rest of this series, this is not a specific call to spend more money if you’re accomplishing your goals without doing so. But for those of us who weren’t or are not, and who are on a long path to financial freedom, this series is meant to encourage you to prioritize your health along your journey and not to feel guilty for keeping (or increasing) health and fitness costs in your budget if doing so will benefit your life.

What adjustments will you make to your budget to maintain or improve your fitness routines? How much do you think you should spend on fitness?

Later this week: Why Mental Health Spending Should be a Non-Negiotable in Your Budget if You Need It

Series Intro: Saving for the Future and Repaying Debt Shouldn’t Cost You Your Present Health and Wellbeing: a Series