How Do I Invest? A Step-by-Step Beginner's Guide to Saving & Growing Money

/Due to a couple of reader requests, I’ve decided to write a guide to basic investments and investing strategies for beginners. Investing is one of the most important ways you can grow your wealth over time, but it can also seem intimidating to people who haven’t invested before or who have lower incomes. Investing can actually be very simple, especially since the best investment advice is “set it and forget it.” With that in mind, I’m going to walk you through some of the things to consider when you’re building your investment plan. If you have investments like a 401k, but you don’t know where your investments go, I can help you break that down and decide where to put your money. If you don’t have any investments, let’s get started!

But first, are you a low- or middle-income person who has trouble making ends meet right now, has a lot of debt, or has little-to-no savings?

Stop. Do not pass Go. Do not invest $200 until you’ve done the following:

Track your spending for a month and find any holes in your budget. Slash where you can. Make ends meet. If there are no holes, find some kind of side hustle to get to the point that you’re making ends meet.

If you can make ends meet, but are having trouble saving, do #1 and start an emergency fund with the difference you build from slashing costs.

Build an emergency fund of ~$1000, do not accrue new debts, and start paying down the debt you have (I’m assuming those minimum payments are included in 1. above)

There are tons of bloggers who focus on making ends meet, such as this post from Frugal Farm Wife and this post from Money Saved, Money Earned. .

Once you’re settled into a budget that allows you to save a little bit (to build an emergency fund) and allows you to pay off debt, even if slowly, you can then introduce very basic investments into your financial plan. The amounts should be small and will be designed to create a savings habit right now, not building wealth rapidly. I’d recommend reading [link] to accomplish 1 & 2 above, as this post is targeted for people in a different financial position (and hey, no shame, been there – you just have other fish to fry than dealing with a 401k at the moment)

Are you a low, middle, or high-income earner who can make ends meet, saves a little money, and maybe has a 401k through work, but doesn’t know how to start moving your investments forward? Do you feel like this dog when you think about investing?

Congratulations! You’re the target of this post! So let’s start at the beginning, shall we?

I recommend the following order of investment/savings for people who are just starting to look at investing on a very basic level (again, we’re talking SET IT AND FORGET IT PEOPLE – nobody got rich day trading…ok that’s not true, but that’s not the point):

High-Interest Savings Account for Small Emergency Fund

401k through work if available (at least 3% or company’s match %)

HSA if available to you

Build up to maxing out your 401k (again, if available. If not, skip to step 5!)

Traditional or Roth IRA

Taxable Investment Accounts

Move 401ks to lower-fee IRAs

Build a larger 3-6 month emergency fund either through high-interest savings account or a low-risk taxable investment account.

You could also do 6 and 8 simultaneously with increasing your 401k to full contribution if you want to have more accessible investments.

Other options include, but will not be covered in this post:

Automatic savings/investment programs like Acorn

Advanced investment programs like NextSeed or FundRise

529 college funds for your children

Advanced investment strategies like building your own ETF investments, targeting dividend stocks, or trading options

Alright, that’s it! Go forth and conquer; the teacher has become the master.

Just kidding.

I’m going to break down everything I just suggested so that you have a little toolkit at your fingertips to help you understand and remember what each of these investments do – each type of account I am recommending has different rules, advantages, disadvantages, and fees.

The most common type of Tax-Advantaged Investment Accounts are:

Retirement Savings Accounts: 401k, Roth 401k, 403b, Traditional IRA, Roth IRA, SEP IRA, SIMPLE IRA

Health Savings Accounts: HSA

Wealth-Building Accounts: Individual or Joint Taxable Accounts

There are other accounts that grow your money, like high-interest rate savings accounts and CDs, but I’m talking specifically about investment vehicles today, not interest-bearing accounts. Interest-bearing accounts guarantee a certain (usually pretty low) return on your money.

Investment accounts historically have significantly higher returns over time than interest-bearing accounts, but investment accounts do come with the risk of losing money (Great Depression, what is UP). This is because most of them are in some kind of fund that either tracks a stock index or indices or actually purchases shares of various stocks, bonds, etc. The details of what is in your investments really don’t matter in the beginning; that’s a post for another day. Just know that it’s not a consistent, guaranteed return on investment, because it’s got investments in moving businesses.

Step 1: Open a High-Interest Savings Account For Emergency Fund

There are lots of decent options these days for high-interest savings accounts - Discover is my personal high-interest savings account (1.65%), but @stephonee has a whole article on hacking yourself into a 5% checking account if you’re up for the challenge (I currently am not, but getting there). Your standard banks don’t usually offer these. It will be places like Ally, American Express, Discover, etc. Most will be online accounts, which is frankly easier to deal with when it comes to savings. Read the fine print to make sure you’re not getting a “promotional rate” that drops after a few months or has a minimum investment threshold. Now on to the real reason we came here:

Steps 2-7: Deposit as much of your money as possible into tax-advantaged accounts in roughly the order I listed above, and as explained below!

Tax Advantages of Various Investment Accounts

Some investment accounts are tax-deferred, meaning you don’t pay taxes on them now. You will pay taxes on the funds when you remove them in the future to use them. These are mostly retirement accounts, and most notably the 401k. Putting money into these types of accounts will reduce your CURRENT taxable income by the amount you invest.

Accounts: 401k, IRA, SEP IRA, 403b

2. Some investment accounts are taxed now, but not when you remove the money. That means that your current taxable income will not change, but the amount you invest today will never be taxed in the future. These accounts are “Roth” accounts - either IRAs or 401ks.

Accounts: Roth IRA, Roth 401k

3. Some investment accounts are always taxable. These will be your brokerage accounts and regular investment accounts. People often refer to these accounts as their “portfolio.” You are only taxed on GAINS when you cash out part of your investment by selling shares. If you sell at a loss, the losses can help offset taxes on gains (but that’s pretty advanced).

Accounts: RoboAdvisor Investment Accounts (Betterment, Wealthfront, etc.); Brokerage

Accounts (Vanguard, Fidelity, TDAmeritrade, etc.)

4. Some investment accounts are tax-deferred, income earned is tax-free and money you spend from the account is tax-free! What magical, magical account is this? The HSA (Health Savings Account). HSA investment accounts reduce your current taxable income by the amount you invest. If you choose to actually invest your HSA funds (as in put them in an index fund or other investment vehicle of some kind), any gains you realize are tax-free. Furthermore, you can use money from the account at any time for qualified medical expenses tax-free (the government has a list of qualified items). This is basically THE BEST ACCOUNT EVER.

Accounts: HSA

Now, let’s talk about the rules of the road. There are very specific requirements for each type of account, and while I can’t cover all of them in one sitting, here are enough basics to get you started!

Investment Rules by Type of Account

401k/403(b)

401k: Only available through an employer (if you have your own company and you are an “employee,” you can create a 401k for yourself and any other employees)

403b: Available to public school, nonprofit employees, and some ministers.

Employee Contribution Limit: $18,500/year

Employer Contribution Limit: $36,500

Over-50 Catch-up Limit: $6,000

Total Annual Contribution Limit from any source: Lesser of $55,000 or your salary (so if you make $40,000/year and you max out your contributions, your employer may only contribute up to $21,500)

There are some additional catch-up options that only apply to 403(b)s, but I won’t cover them today.

Withdrawal Age Restriction: You cannot withdraw funds from these accounts without a penalty until you are 59 ½. If you do so, you will incur a 10% fee on top of whatever income taxes you have to pay on the withdrawal. There are a few exceptions to the minimum withdrawal age, such as college tuition, medical expenses, etc, but you have to apply for a Hardship Withdrawal. To keep it simple, tell yourself you can’t touch your 401k until you’re 59 ½

Required Distribution Age: Once you reach 70 ½ years of age, the IRS will require you to make withdrawals from the account annually. Here are the IRS’s calculations on required withdrawals. https://www.irs.gov/retirement-plans/plan-participant-employee/retirement-topics-required-minimum-distributions-rmds

After you begin taking withdrawals, the amount you withdraw annually will be taxed as ordinary income. However, all of your contributions will grow tax-free for all of your working years and you will have a lower tax bill during your working years. For many people, this makes sense because they will have lower income in retirement and thus the money in the 401k will be subject to a lower tax bracket when it is taxed later than if it were taxed now. #winning!

Average Fees: .5-1% (pretty high)

Talk to your HR professional at your company to figure out how much (if any) the company will match and to adjust your withholding to get that free money!

IRAs (Traditional, Roth, SEP)

Eligibility to contribute to these accounts is based on income.

Contribution Limits:

The maximum cumulative annual IRA contribution across all IRA accounts and types (i.e. if you have a Roth and a Traditional IRA, you can only contribute $5,500 total across accounts) for an eligible individual is $5,500, or 100% of your salary, whichever is less. If you are 50 or older, the limit is $6,500.

Roth IRAs have Dollar Amount Contribution Limitations Based on Income: Your income determines the maximum amount you may contribute to a Roth IRA. If you make too much money, you will not be able to contribute as much (or in some cases, at all) to your Roth IRA. You may always contribute up to $5,500 to a Traditional IRA (minus any other IRA contributions, of course), but it may not all be tax deferred (see below)

Traditional IRAs Have Tax-Deferment (Deduction) Limitations Based on Income: Traditional IRAs are tax-deductible based on your income. As you make more income, you will have a lower maximum amount you can deduct from your current taxable income. Roth IRAs do not offer deductions on your current taxable income; they are non-taxable in the future.

SEP IRAs Have Contribution Limits Based on Income, but do not count toward the $5,500: Any person who is self-employed (i.e. a 1099 worker) may open a SEP IRA. You may contribute lesser of 25% of income or $55,000.

Fidelity has great charts outlining eligibility, which I have screen-grabbed here:

THanks, Fidelity!

2017 & 2018 Traditional IRA Deduction Requirements

Thanks, Fidelity!

It also has links to calculate your eligibility amounts if you click the original link above!

Distribution Requirements:

Pretty much identical to 401k withdrawals above. You may start taking distributions without penalty at 59 1/2. You must start taking distributions of your IRAs at age 70 1/2. You may face a penalty if you make a withdrawal, similar to taking an early 401k withdrawal. Here is the IRS outline of distribution rules.

Fees: Can be .5-1% if you choose a traditional provider (many 401k providers...like Fidelity, T. Rowe Price, etc.) or can be very low (Free-~.25%) if you open one through a robo-advisor like Betterment or Wealthfront.

Health Savings Accounts (HSA)

HSA Eligibility: You must have an ACA-approved High Deductible Healthcare Plan (HDHP). It can be from an employer, the exchange, or wherever you get your health plan.

To be an HDHP, an insurance plan must not cover any claims with copay or coinsurance until the deductible is met. It can provide basic checkups, annual exams, and some prescriptions. Basically until you meet the deductible, you are paying for pretty much everything out of pocket.

Here’s a chart from the IRS outlining the minimum deductible/out of pocket maximums for HDHP qualification:

HDHP Contribution Limit: $3400 individual, $6750 family (from any source -sometimes employers offer matches or contributions. I’ve had this and it was fabulous)

You usually have a certain amount in the plan in order to invest (rather than the money just sit there), but it’s a great little tax-avoider and a natural medical issues sinking fund. If you really want to dig deep on tax-advantaged health accounts, the IRS is at your service. Their website is actually pretty cool.

Taxable Investment Accounts

There are TONS of options for how to open taxable investment accounts and how to allocate your assets therein. For beginners, I recommend either Wealthfront or Betterment. I currently only have a Betterment account, but I’m looking into moving one of my 401ks to Wealthfront because they’ll manage $10,000 free or $15,000 with a referral. Betterment charges a .25% management fee, which is low (most 401ks charge .5-1%). Ellevest is also making a splash targeting women investors (but anyone can sign up!).

Eligibility: Anyone can open an investment account.

Fees: Varies. Robo-advisors are free or ~.25%, depending on which you choose.

Betterment and Wealthfront use mostly ETFs (exchange-traded fund) to automatically fund investment accounts that track various indexes, like the S&P 500, mid-cap stocks (midsize companies), international stocks, etc.

They will walk you through your goals and preferred risk profile when you register and then it will automatically populate your investments. You don’t have to touch anything if you don’t want to (and they recommend you don’t). 90/10 stocks/bonds is a pretty common ratio. They’ll even rebalance for you when your investments get out of proportion!

For beginners, I highly recommend opening a robo-investor Taxable Investment Account to throw money into at least until you learn the ropes a little better – but frankly, they are the most advanced option you need if you want to keep things Very Simple.

So that’s it – a list of suggested investments to start, and a breakdown of the basics of each. If we revisit the list, your long-term investment numbers should look something like this (as your income grows and allows, of course):

High-Interest Savings Account for Small Emergency Fund ($1000 to start)

401k through work if available (usually 3-6% match on pre-tax income, or 3% minimum if your company does not match)

HSA if available to you ($3400 max, including employer contributions)

Build up to maxing out your 401k (again, if available) ($18,500 per person excluding employer contributions)

Traditional or Roth IRA ($5,500 per person cumulative)

Taxable Investment Accounts (As much as you want! Again, you can do a little bit here on a regular basis while working on maxing out the tax-advantaged options)

Move 401ks to lower-fee IRAs (No time for this today)

Build a larger 3-6 month emergency fund either through high-interest savings account or a low-risk taxable investment account. (Varies, usually $10-20k)

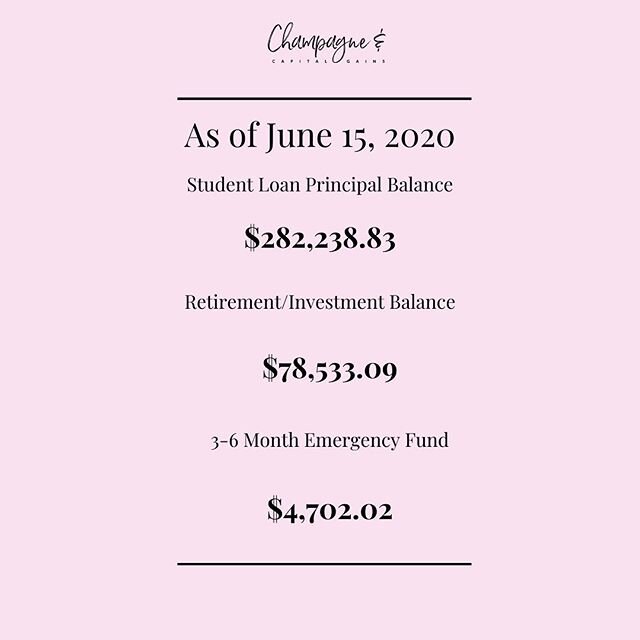

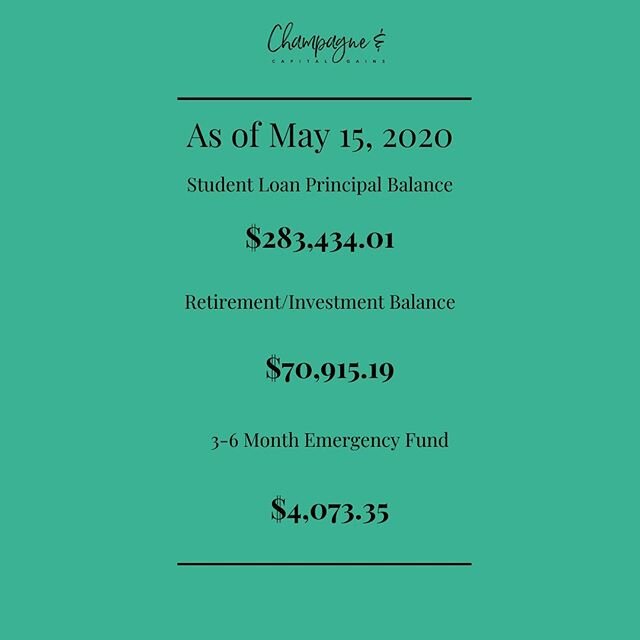

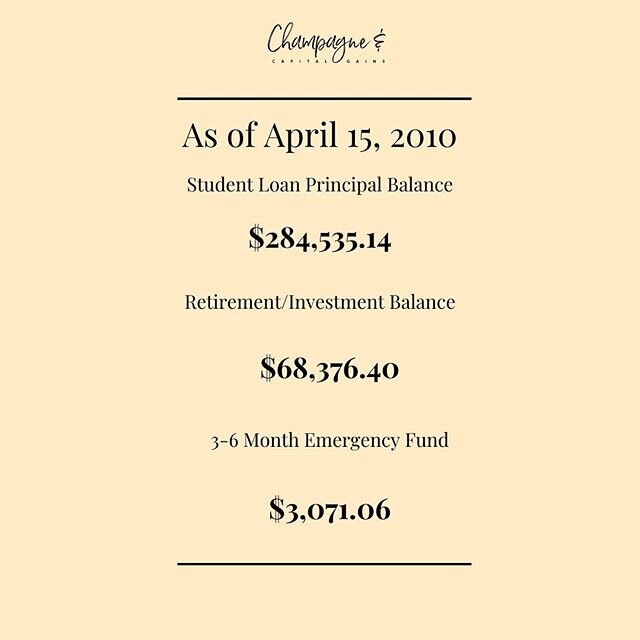

Finally, here's my own current investment plan as an example (it doesn’t follow the specific steps, but I'm not just starting):

Emergency fund in high-interest savings account, to which I currently contribute $100/month.

Personally maxing out my current 401k (aka the full $18,500). I also receive a 4% employer match on top of that, which is AWESOMEEEEE. Pretty high for a law firm. Some don’t do a match at all.)

Several 401ks from past jobs I haven’t rolled over into IRAs (hello, high fees I’m wasting money on...don’t be like me! If you switch jobs, roll your 401k into a low-fee IRA!

SEP IRA from when I was self-employed. Technically with my businesses I could put any profits into this account to offset my tax bill.

Taxable Investment Account with Betterment, to which I currently contribute $100/paycheck, or $200/month. This could also be an extended emergency fund account, as it is accessible without penalty and is fairly liquid.

I don’t do any active investment or management at this time, though I’m looking into it for the near future. I don’t trade in options or futures, and I don’t use any of the automatic-investment apps like Acorns. My accounts are all in 90% stocks/10% bonds, usually filled with a variety of stock index funds.

I honestly let Betterment and my 401k managers just set the account makeup and don’t play with it. I plan to roll over all of my 401ks and eventually get into some more advanced investments, including real estate, but none of that is necessary at this time and I don’t currently have the time to deal with it.

My investments are automatically pulled from my paycheck by my employer or auto-drafted out of my checking account. I don’t time the market or panic and withdraw money when the market takes a dip.

Conclusion

Investing in an automatically diversified account and leaving the money alone is actually the most consistently successful investing strategy. Especially if you aren’t financially savvy (YET!) and are just dipping your toes into investing, I recommend this strategy. It doesn’t have to cause you a lot of pain and angst. Just get your money working for you and go back to your life. And it’s FUN to watch that account climb higher!

The biggest thing to remember is that investing and finance are not one-size-fits-all. This post is just a template! I think it’s a great outline that will get you started, but you should feel free to do a little of everything as long as you at minimum have your $1000 emergency fund in place and are maxing out your company’s 401k match.

What investment strategies do you currently have? What are you planning to put into action after reading this post, and what questions do you still have?