2018 Recap: Champagne & Capital Gains is 9 Months Old! Blog, Money & Life Highlights

/Happy 2019, everyone! The blog is rounding the corner toward its first full year and I am so pumped for where it’s headed. This year has been a big one for me, and I’ll cover 2018 in its entirety in my recap/preview post. But Q4 was a wild ride in itself. I left FinCon on a blogger business-building high, and crashed when I found out my mom is sick.

This quarter saw a ton of travel for weddings, holidays, and family visits. I celebrated one year at my current job with no end in sight (fingers crossed). Actually liking my job most of the time is a new feeling I hope continues for the forseeable future. I finished off the year with a a Chili & Chill New Year’s Eve gathering at my house and it was PERFECT.

Nine Champagne Glasses filled with Veuve for Nine Good Friends ringing in the new year like grown adults.

I’m looking forward to 2019, although I can’t believe it’s already here! 2018 seemed like it just started (and also like it was 85 years long…anyone else?) Can’t wait for new challenges and to build on everything I accomplished in 2018.

The blog is nine months old, and I had lofty goals for the fourth quarter of the year, so let’s get to it to see how I did!

Financial Highlights

Q4 Goals Review:

Sell $50/mo on Poshmark or other site

Set up a Budget for 2019

Use Travel Rewards for Flights/Travel + No Credit Card Hacking

Hit $50k across my investment accounts

Sell $50/mo on Poshmark or other site

I sold $122 on Poshmark during the 4th Quarter ($28 short). So I didn’t meet my goal, but I did pick up sales again for the first time since May, which is a big improvement and that came from focusing on the sales goal. I’m committed to sharing items more consistently on the platform to increase the frequency of my sales.

This platform can be SO frustrating, but I don’t like to donate things (because donating to socially-responsible places is actually kind of hard…) when I could contribute to the recycled clothing economy and make some money for my own financial goals. Poshmark has consistenly provided the most success for me, so I’m keeping it simple and putting my efforts into that for this quarter.

I think $150 is doable because I have a lot of new items to list (a sub-goal: list lots more items). We’ll seeeee!

Set up a Budget for 2019

Success!

Sort of. I did modify my 2018 budget for 2019 in a Google Sheets template and I’m working a little bit more on it now that I know how much my paycheck will be each month. (Pro tip: You can ask HR for that amount after they run payroll for the period, or you can use sites like Paycheck City, which are generally accurate, but not always dollar-for-dollar).

The budgeting I did do helped me to see I need to decrease some expenses and increase my income, so it’s helpful in that way, but I wouldn’t say it’s currently a “workable” budget in the sense that I could follow it, have built in hiccups and one-off expenses, and still know where I’ll be at the end of the year.

Use Travel Rewards for Flights/Travel + No Credit Card Hacking

I did pretty well with using points for flights! Bought flights to Mexico and NYC (twice) on points, which saved me ~$1000 (and allowed me to earn qualifying miles and dollars for status because I booked through the Chase portal on most of them. This is a hack I use a lot now.)

Ended up booking all hotels with $$$ because I didn’t have points for most of the places I was staying (Brooklyn has one Marriott property in the whole borough and it was nowhere near the wedding venue…can you believe that? Wild). I did use cashback apps and max out my points spending where I could, and for the wedding I split a room with people for the night of the wedding.

When I booked my hotels, I chose less expensive options than I wanted to because I’m trying to make the better financial decision wherever i can this year. It worked out completely fine! I wouldn’t recommend going as low as the Extended Stay like I did for FinCon, but subbing a boutique for the Courtyard Marriott wasn’t a big deal.

The credit card hacking ban succeeded if you don’t count the fact that I opened a 0% interest balance transfer card to deal with some of those poor spending habits I mentioned in my last review… I feel like this was fine, because I didn’t do it to travel hack and it is saving me hella interest on those bad decisions. The card I used actually had a 10,000 points offering and 2% cashback on groceries in addition to 0% interest and no fees on balance transfers, so is it the holy grail of credit cards? Probably. It’s the Amex Blue Everyday card and here’s a referral link if you’re interested in applying. It’s legit. (Not sponsored, the card was just exactly what I needed!)

I’m going to front-end my personal training spending for 2019 so I’ll probably try to get a card for that because why leave hundreds of dollars of free travel on the table? But that is Q1 of 2019 and therefore doesn’t count for this goal, right??

Hit $50k across my investment accounts

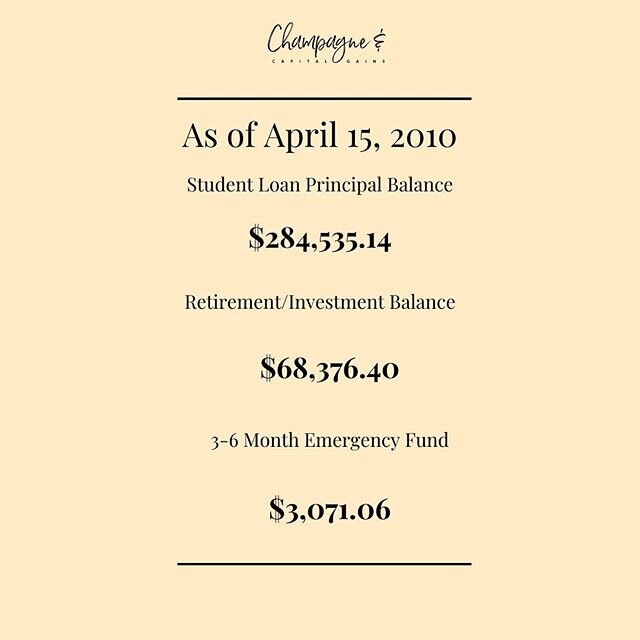

This happened! Right before the market tanked :D I’m at $50,639 as of publication with money from my December 31 paycheck, which counts for Q4. This is a huge milestone for me because I’ve had a lot of work and personal turmoil since I graduated from law school 4 years ago. The fact that I have been able to invest $50,000 towards my future during that time (in addition to my cash emergency fund) makes me so. freaking. proud.

For Q1 of 2019, I am reducing my 401k contribution to focus on other financial goals, but the net change in my paycheck is so small compared to how much it would be if I were making the maximum contribution that I doubt I’ll sustain the decrease all year. Seeing that $25,000 build my 401k over the course of the year (from my contributions and employer match) while also destroying my tax rate is super satisfying.

Other Financial Highlights

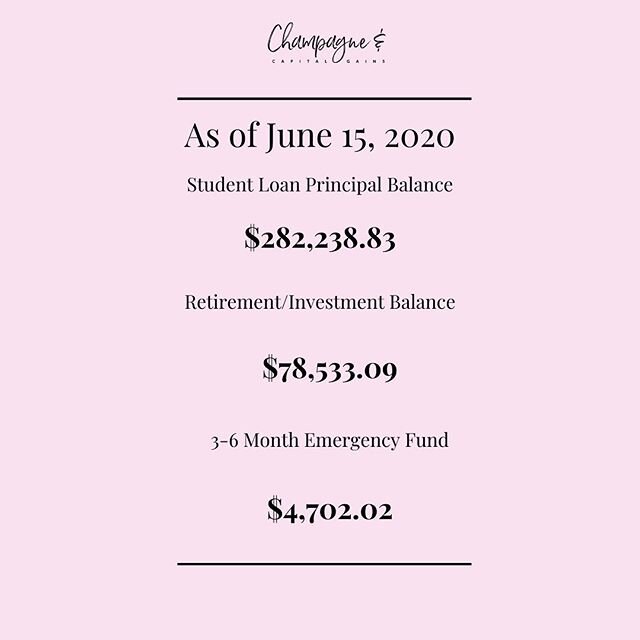

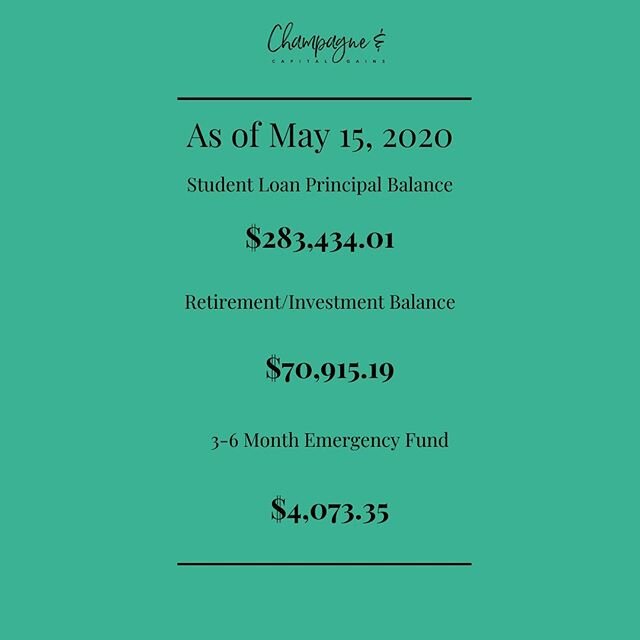

I’m under $300,000 on my student loans!

That number is still depressing as hell, but I’ve been waiting A.WHILE. to even tell y’all how much student loan debt I actually had because I wanted to hit this milestone first. My refinances in the past 16 months have helped this number tremendously. My AVERAGE interest rate on more than $300,000 was 7%. OUCH. After my variable-rate loan rate steadily increased for a few months, I locked in a good fixed-rate offer and refinanced again. I’m now at 5.25% for 20 years (though if you think I’ll be paying this for 20 years, you cray.)

I strategically hacked (and flew) my way to American Airlines Platinum status through January 2020 while also using up some Southwest points I had lying around that I wouldn’t have used otherwise.

This was fun. I needed $50 of total airfare spend to complete my Platinum status with American and the flights to Mexico were expensive. Since I am only flying American these days, I had some Southwest points I hadn’t touched. Because I’d reach my status goal with one leg on American and woudln’t have had the chance to get to the next status level, I was able to “get rid of” Southwest points for one free leg and used Chase points to book the other leg on American!

Let me note: I did get status initially via a challenge, and I didn’t spend all the airfare money out of pocket because I used a lot of points. But I earned my 50,000+ EQMs and $6,000 EQDs outright for my 2019 status. I flew THAT much in 2018.

And here’s a look at Mexico so you can see how #worthit the trip was!

I received a cost of living raise and a bonus, so my income will increase by a couple hundred dollars per paycheck and I was able to make a dent in my student loans by paying an extra month and also beefed up my EF with the remainder of my bonus.

Remember, I’m Fired-proofing myself in 2019 so I’m focusing on cash for a little while.

Financial Goals for Q1 2019

I’m going to do a general 2019 overview post that will outline my full year goals, but as Tim over at Atypical Finance points out, breaking goals into smaller chunks is much more effective than writing down sweeping hopes for your year.

Financial goals are going to be difficult but I’m going to stick with a couple from last quarter for Q1 2019 goals:

Sell or earn $50/month on Poshmark + cash back apps like Ibotta.

Increase my 3-6 emergency fund to $5,000

Track all my spending (probably using You Need a Budget, but not sure yet!) in food/shopping categories and reduce spending in those areas

Q4 Blogging Goals Recap

Complete 13 Posts in October

I completed 5. Frankly, 13 was beyond ambitious, but 5 posts was still more than any month to date, and I started the Friends series that carried me through November. So, while it wasn’t a total win, it did get me focused on posting more often and gave me consistent content for several weeks thereafter. I’ll take consistency over perfection. I doubt 13 posts/month will ever happen but you never know. Stay tunded to find out!

Related Posts: Money Lessons I Learned from Friends | Rachel | Ross | Joey | Monica | Chandler | Phoebe

Syndication with The Financial Diet: Fail

I didn’t pitch TFD and they didn’t pick up any of my pieces on their own. So I just have the 2 previous ones under my belt. Lots of opportunity here to step up my game!

Another Rockstar Feature: Success! (Sort of)

I got a feature on January 6 that I pitched during December, so it kind of counts. (They featured “When Does Self-Care Become Self-Sabotage (And How to Do Self-Care Well!)”) The difference between my TFD failure and my Rockstar success, though: pitching. So in 2019, I’ll be pitching posts and articles much more!

150 Subscribers

I’m at 109 as of publication, and I crossed 100 before the new year, so while I didn’t hit my goal, I did increase subscriptions and I’m on the right track. If you don’t subscribe, I’d encourage you to do so because I have fun plans for my mailing list in 2019!

Sending emails successfully in Q4 was another story entirely…

Basic Business-Building Plan

I’m not sure if I hit this goal? I do have an idea of things I want to accomplish and I’ve sort of written them down, but not in any structured way.

I did grab drinks with the lovely Stefanie O’Connell when I was in NYC in October and she is straight #goals, yall. We discussed that my greatest constraint is my TIME. That means I have to triage certain things right now to make room for more important things.

So for example, my Instagram Highlights aesthetic is lacking big time because it’s not beneficial to me at the moment for how much time I’d have to put in (it IS on the list, though). I am getting some traction from curating my instagram feed/stories better, so I’m putting time and effort into that first.

Content creation, and particularly my subscriber hook, is a big goal that I’m working on for the next quarter.

Other Blog Highlights:

Here’s a screen grab of my views for Q4 and for all of 2018!

Q4 2018 Blog Views

Not bad at all for not having been rockstar’d in q4.

I’m averaging ~2,000 pageviews per month since getting my first Rockstar feature, which is approximately double what I was averaging for the first six months of readership, so we’re trending up! No complaints there.

Total Blog Views Since Launch (March 30, 2018)

Holy moly, that’s a lot of views! …for a new, part-time blogger.

Oh my gosh you guys. This is insane to me. More than SEVEN THOUSAND individual humans visited my site this year. Almost fifteen thousand pageviews! In 9 months! Sure, I could be doing better, but for everything else that I’ve had going on this year, I’m so, so proud of the number of people I’ve reached through my site so far. Thank you so much for reading, yall!

Again, I didn’t post as often as I’d like to, but I did create a fun series and still managed to keep things active despite finding out my mom is sick.

I’m also working with other bloggers in a Mastermind group to up our games and if I can carve out the time for building the blog, I think the work will pay off.

Q1 2019 Blogging Goals

Again, I’ll highlight the full year’s goals in another post, but these quarterly posts I already to for yall really help keep me on track.For this quarter, I want to:

Post 12 TImes: This equates to almost once per week. Really, I’d like to be at 2-3x per week, but that has proven to be a pipe dream for me these days.

Update links/related posts on all my previous posts

Develop my subscriber freebie

3,000 Twitter followers, 1,100 Instagram followers, 150 subscribers < going for it again

So that’s about it! I’ll catch yall in April for the Q1 review and MY FIRST BLOGAVERSARY!

How did yall do on your financial goals toward the end of the year? What kind of content would you like to see on the blog in the future? Let me know in the comments!