The Time I Bought Amex Gift Cards with My Target Card: Desperate Money Hacks to Avoid Payday Lenders or Missing a Payment

/This is the second part of a two-part series entitled “Creative Choices in Desperate Financial Situations,” (HERE’s Post 1) in which I talk about some of my darker financial days, how I survived them, and how you can use them if you’re in a pretty bad financial spot. For example, unemployed in a global pandemic???

My first job started two weeks after I took the bar exam, but I was taking the bar exam almost three months after graduating from law school. My employer was going to reimburse me for the test and bar study course (I negotiated that when I got my offer), but I was on my own for the summer in terms of living expenses. Student loans are only disbursed if you're take a class and, well, the bar exam just doesn’t count for that.

Some of my classmates were living on the $10,000 bar study stipends their big law firms were paying them, which were on top of the starting salaries of $160,000 they’d be receiving when they began their jobs. I would be starting at $65,000 and I was on my own for the summer. Like pretty much 100% on my own.

My parents covered *only* my car insurance and cell phone through law school and I stayed on their insurance plan through my 26th birthday, but that left me high and dry for a few months. I chose a temporary plan, but toward the end of the summer, I let it lapse in anticipation of the new job starting soon. And I was broke. So broke.

Fortunately, I’d kept about $5,000 from my BigLaw job the summer before my 3L year in a savings account to pay my rent and my deposits in my new city, but as a broke person with no money coming in, I was hoarding cash and most of it was already earmarked.

My two low-limit credit cards were maxed out by mid-July. I had another 6 weeks to get through before I’d receive a paycheck. How was I going to make it?

I’d like to note that my parents really couldn’t bail me out of this. My parents are wonderful and have given me so much and set me up for success in many ways, but they are not wealthy people by any stretch of the imagination. They MIGHT HAVE been able to pay my bills for a month, but they were teachers ballin’ on a budget of their own and it would have been a HUGE financial burden for them. I was not about to ask that of them when I was mere weeks from employment.

This was a desperate time, y’all. Really desperate. And it still wasn’t as desperate as some peoples’ normal lives.

I’ve been fortunate. I’ve never missed a payment on rent, a bill, a credit card payment. Nothing. Tori Dunlap wrote a post that people should celebrate little money victories like getting current on bills (YES YOU SHOULD). Carmen from Make Real Cents said she used to be on a first-name basis with the payday lenders down the street.

That particular type of financial struggle has never been my life. I’ve been (and still can be) ABYSMAL with money at times, but I’m a phenomenally creative lady who’s always had an unusual interest in reading about and learning money hacks, so I had enough financial knowledge and hustle to keep myself afloat in ways that some people (1) wouldn’t know was possible, (2) wouldn’t think of, or (3) both.

I want to share my crazy ways with you today so you can benefit if you’re also in a desperate moment and have decent credit. If you don’t have decent credit, these things probably won’t be as helpful (which is why I am ALL about building credit. It is helpful in rough times and in regular times).

A lot of people on Debt Free Journeys cut and cancel their credit cards and live on cash. That works for some people. But credit cards (and a little bit of hustle) literally got me through my bar study summer. They helped me avoid financial disaster. And I will absolutely NEVER recommend someone close a credit line unless they are compulsive shoppers or gamblers on the level of needing a televised Intervention, completed with TV crew and familial ultimatums.

In fact, I think it is irresponsible in many cases to tell families living on the edge to shut off a lifeline that is FAR better than most of the alternatives (I talked about this in the last post too). So, how did I survive? And how can you survive if you are thisclose to the brink of disaster but don’t know where to turn?

Here’s a list of 5 things I either did or you could do to avoid payday lenders, title loans, pawn shops, missing payments, or other absolutely devastating, predatory means of making it to your next paycheck.

Work Some Low-Commitment Hustles

Apply for a new credit card, preferably one with a 0% interest rate

Activate low-interest offers on your existing cards or call to request a lower rate

Discover Cards actually offer CASH balance transfers if you’ve had an account with them for at least a year Buy Amex or Visa gift cards with your credit card to shop other places or pay non-cash bills

Call to get late fees removed or to get deferrals if it’s truly a short-term situation and you have a good history with the company.

This list is intended to be for temporary financial situations - like a government shutdown, for example, or the time between graduation and a job start date. (HELLO COVID)

This list is not specifically intended to be used as a general money management strategy, but frankly, if it helps you get current on your bills, have at it. I’m not going to judge you improving your situation if improving your situation right now would mean a 16% interest rate on a credit card vs a 300% APR on a payday loan.

Progress is progress. You don’t have to be perfect with money today when you’re trying to get through the day.

Back to the list in full:

(1) Work Some Low-Commitment Hustles

I got on Care.com and SitterCity and found the best-paying baby-sitting gigs I could. You know what you can do while kids watch TV & eat pizza (or sleep)? Study for the bar. You know what you get in return? Money to pay your bills.

Babysitting paid multiple of my car payments that summer.

People who have zero income and bills to pay do not get the luxury of studying for the bar 24/7 without building in some time to make some income. I don’t know your situation, but I know if you’re not working full time, you can find time to hustle, and in fact you kind of have to if you don’t have access to other funds. Otherwise you’ll run out of money.

It sucked. I wish my parents could have paid for me that summer the way many of my classmates’ parents or law firms did for them. But that wasn’t my life, so I made money happen. If you aren’t born with it, you have to hustle for it or you won’t have it. Sucks, but that’s life. Choose side gigs that you can ideally do for the most return on your time but that don’t prevent you from studying, job searching, or whatever you need to do to make sure you keep your future promised income. Good options to consider:

Babysitting: look for high-paying gigs if possible that are nighttime, infants or older kids so you can maximize your study time or your time doing something else productive that will lead to income

Pet or house-sitting: Same thing. Sleeping over at someone else’s house while they’re out of town will give you cash, no less free time than you already have besides a small dog walk or two, and might even save you some money on your own home’s utility bills. Win, win win.

Dogwalking: Different than petsitting because their owners are paying you just for taking them on a walk or to the potty while they’re at work. This is a pretty low time commitment gig that can get you out and moving, which is good for your health in addition to the financial benefits!

Food/Grocery Delivery: Instacart, DoorDash, etc. are great ways to earn extra money, even if you’re just picking up someone else’s meal or groceries while running your own errands. Tips vary, but if you strategize your timing, you can do really well.

Uber/Lyft: Not for everyone, but it’s definitely flexible if you’re job searching!

The Financial Panther writes about his side hustling (he’s also a lawyer). Here’s his list of The Ultimate List of Gig Economy Apps to get you started! If you’re studying for the bar rather than job searching, avoid selling things online, late-night driving for rideshare companies, or other time sinks with low returns or that distract you from your studying (if that’s the situation you’re in).

What other low-commitment side gigs have y’all done?

(2) Apply for a new credit card, preferably one with a 0% intro rate

You can use your actual income if you’re furloughed or you can use your student loan and/or starting income for your job to apply for the card. Make sure it’s a credit card you pretty much know you will be approved for.

Sites like CreditKarma and Mint will give you approximations of your approval odds for any given card or you can look for pre-approved cards with a given bank using your personal information.

If you open a credit card with a 0% interest intro rate, you can spend during your no-income period without racking up interest. That’s helpful because it reduces the amount you’ll have to repay once you actually go back to work full-time.

Lots of cards with 0% interest rates also offer low-or no-fee balance transfers, which isn’t necessarily relevant to temporary cash flow issues, but could be a helpful option if you’re also dealing with high-interest credit card debt. You can transfer those higher-rate balances and reduce your monthly payments in addition to reducing the amount of interest it is accruing while you’re repaying it in full after your regular paycheck kicks back in.

Here’s a list of cards with 0% introductory rates (a lot of them have awesome points benefits too!) and here’s a list of cards that have both a 0% introductory rate AND no balance transfer fees for initial transfers. Finally, here’s a list of cards for people with Fair (rather than Good or Excellent) credit. Watch out on the Fair Credit list - some of those cards don’t have 0% intro rates.

Interest is still better than a payday loan, but watch for that when you’re making a choice.

(3) Call to get late fees removed or to get deferrals if it’s truly a short-term situation and you have a good history with the company

If you do miss a payment, call to ask them to remove the late fees and/or defer payments for a month or two. Explain the situation (a LOT of companies are offering help to furloughed employees, but they will probably be willing to work with you between jobs too) and make sure you tell them that you are employed, you’re just experiencing a paycheck delay or that you’re in the awkward, post-graduation months but can prove your future employment with an offer letter.

They won’t usually offer help more than a couple of times in a year or two, so try to use this sparingly. You can also do this after your paychecks resume and ask the credit card or utility company to remove it from your credit report, but getting ahead of something is always better than getting behind if you can help it.

(4) Discover Cards (& some others) actually offer CASH balance transfers if you’ve had an account with them for at least a year

This means the bank will deposit actual cash into your bank account and add that amount to your credit card balance - but it’s not considered a cash advance on your card. It’s transferred at the balance transfer APR and/or transfer fee, which is usually MUCH lower than a cash advance rate.

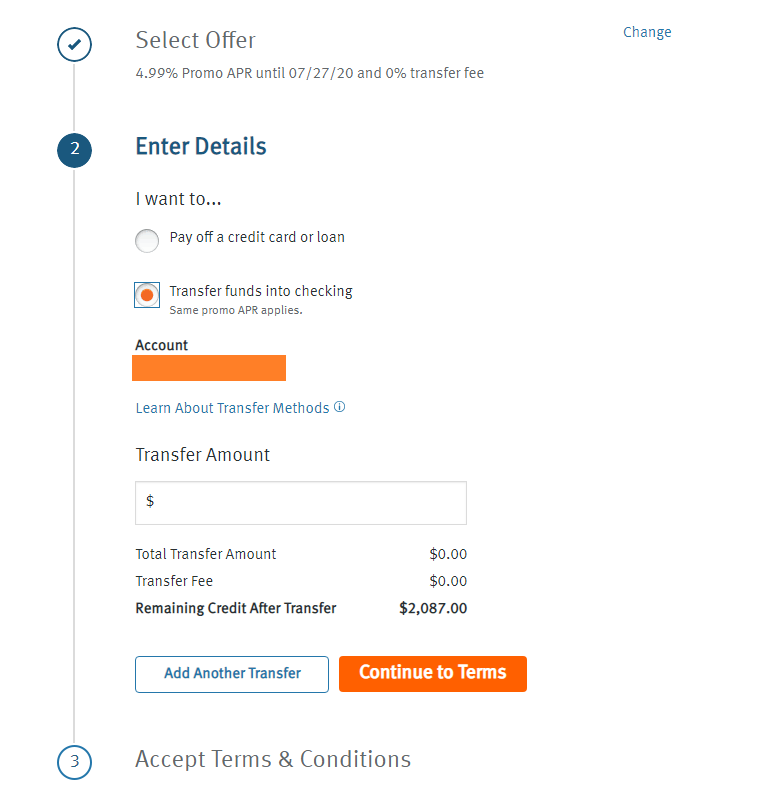

Discover’s typical balance transfer choices for existing cardholders are a 3% fee at 0% interest for 12-18 months or a 0% fee at 4.99% interest for 12-18 months. So you could get quite a bit of cash at a very low rate without going ANYWHERE NEAR a payday lender. Here’s a screenshot of my typical balance transfer options:

Balance Transfer Choices: $0 Fee or 0% Interest

The screen on the left shows the two balance transfer offers that are available, along with how much money you would save if you transferred the balance listed ($2,087 for this example) at either of the two offered terms and then repaid it over the full course of the repayment period. If you’re experiencing a temporary income interruption, you’ll obviously be able to repay that much faster.

If you are going to have a paycheck in the next couple of months, such as recent grads studying for the bar who have a job lined up, you should choose the 4.99% interest and $0 fee option, because 2 months of 4.99% APR is WAY less money than a flat 3% fee on the whole amount.

You should only chose the 3% fee and 0% interest option if you’re going to take more than 7-8 months to repay the loan, because that’s the rough breakeven point on when 4.99% interest on the balance will equal the same dollar amount as the 3% fee. (I’m not accounting for principal reduction at all so that will add a couple of months to that timeframe). Are your eyes glazed over from the Algebra yet?

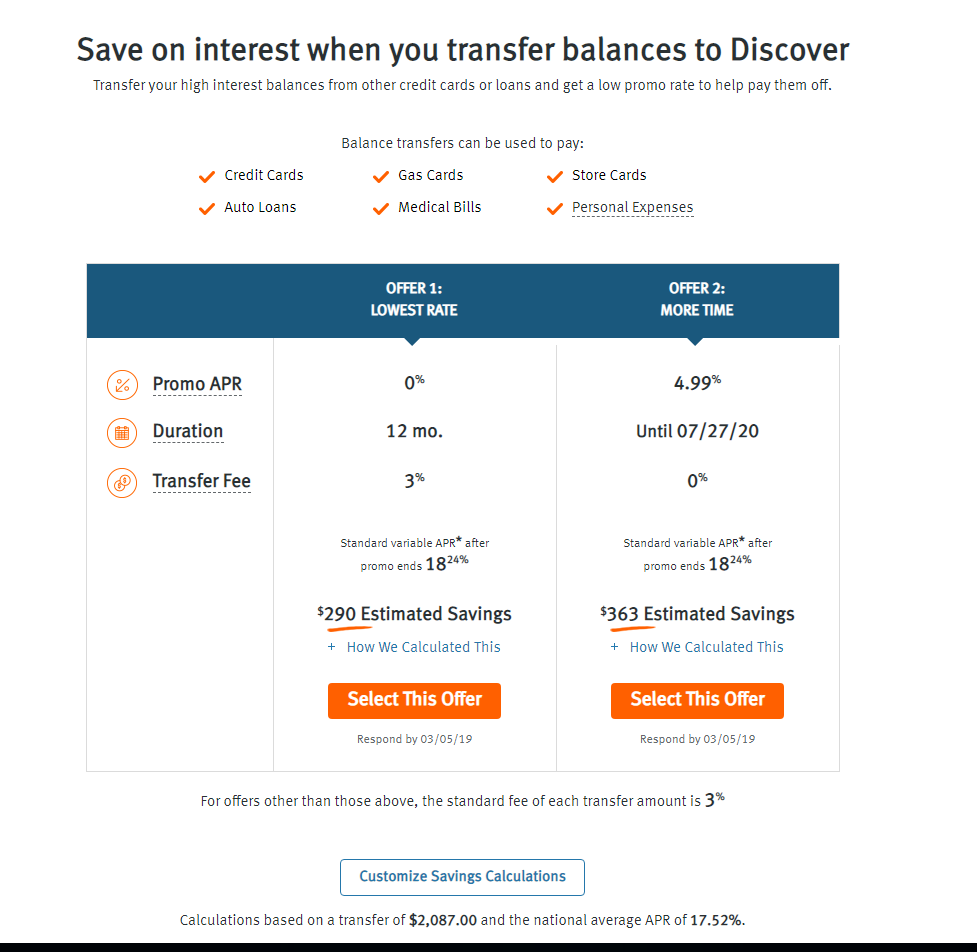

Transfer Funds Into Checking Option

The screen on the right shows the option to “Transfer funds into checking” (I’ve hidden my account number :) but it would list your account transfer options there). The only big rule they have is that the transfer has to go to an account that has been connected to your card for at least one year, which means you won’t be able to do a “funds into checking” transfer if you’re a new cardholder.

Again, they transfer this money to your checking account with no questions asked and you’ll then repay the balance via your monthly Discover bill at the terms you selected on the previous screen. Discover cards are THE BEST. It’s the card I’ve had second-longest, has no annual fees on any card, and has consistently great customer service. If you’re interested in applying, you can use my referral link to get a $50 statement credit after your first purchase within 3 months of opening (I’ll also get a $50 credit - win/win, right?)

Other cards sometimes offer this checking account transfer deposit, but I only have personal experience with Discover. Would love to hear any experiences you may have had with different banks!

(5) Buy Amex or Visa gift cards with your credit card to shop other places or cover bills that don’t require cash payments

At the time, only had a 3 credit cards (besides my J.Crew card which was entirely useless besides helping my debt ratio). My regular Visa was maxed out (I think I had like a $4,000 limit) and so was my Discover card (that had a ~$3,000 limit?) so I used my Target credit card to buy a couple of Amex gift cards. I used those to grocery shop, buy gas, pay my internet bill, and other similar things. You can do this with pretty much any credit card and any gift card, but I’ve found the cash gift cards work best.

Buying cash equivalent gift cards with a store credit card because I had no other way to make necessary purchases is probably the financial moment I’m most ashamed to share with you (besides one other that I won’t share with you because it doesn’t provide any instructional value whatsoever except not to hook up with manchildren, which is kind of a given).

What I did is not even “shameful” - I chose to creatively solve a situation using the resources I had and I avoided missing a payment or hitting up a cash advance store while I was at it. That’s actually amazing! And in some ways, I’m super proud of myself! But I want y’all to know that I know the feeling of shame that being at the end of your money rope can bring.

I’m sharing these tips and my desperate moments because I’ve been there and I want you to have access to information and idea you might not immediately consider when you’re in those panicked financial situations.

Note: You may have to ask for permission or justify buying “cash” gift cards with a Target Credit Card. I’m not entirely sure why, but just say you’re getting gifts for someone (YOUR FUTURE SELF WHO WON’T HAVE MISSED PAYMENTS ON THEIR CREDIT) or whatever you need to say to feel ok about it without revealing that you’re BROKE AF. Try to do self-checkout to avoid that whole mess if you can.

4 and 5 are FABULOUS ways to avoid payday lenders or other sketchy loans with astronomical interest rates.

You already have the credit lines established (ideally: this is why I would always keep a couple active cards even if you don’t use them normally) and you can parlay those credit lines into usable currency, even if it’s a store card like a Target card. If you can get actual cash without taking a cash advance, even better.

Heck, even cash advances are better than payday loan rates.

Think outside the box.

You. Can. Do. This. And you won’t be alone.

Am I the only one who’s used outrageously creative money strategies to survive being #brokeAF? Or to survive when you were truly in desperate financial straits? Tell me stories in the comments about what you did, how it went, and where you are now!

Post 1 of 2 in this series: Surviving Semi/Unemployment: I Lived Off of My Credit Cards Because Spending an Emergency Fund is Actually Terrifying